The US dollar has been drifting lower against the South African rand towards the end of the year. That being said, we are still very much in an uptrend, and we have to pay close attention to the idea of the South African rand being an emerging market currency. In other words, this will be a pure “risk on/risk off” type of set up.

Originally, the South African rand got crushed due to fears of the new omicron variant, but we have since seen the variant turn out to be much more mild than anticipated. Because of this, the South African rand has received a little bit of a reprieve, but the question at this point in time is whether or not we are going to have a major “risk on rally” when we kick off the next year. If we were to see that, then this pair should continue to fall.

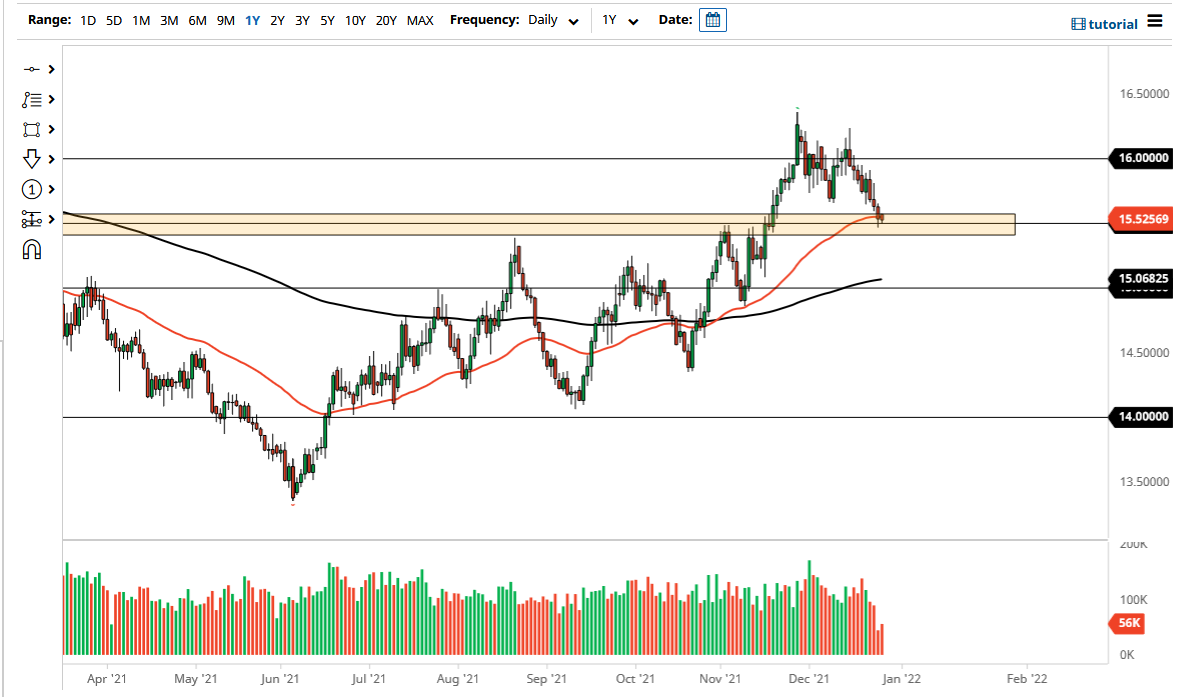

This being said, the 50 day EMA sits right where we are right now, and we are testing an area that previously had been significant resistance. “Market memory” could come into play here, as it used to be such significant resistance, so now one would assume that it is going to see a significant amount of support. If we can break above the top of the range that we are in, roughly 15.6, then I think we will go looking towards the 16 level. It is a little bit of a double top in that general vicinity, so you need to pay close attention to that barrier.

On the other hand, if we were to break down below the 15.4 level, then the market is going to drop towards the 200 day EMA which currently sits at the 15.06 level. One thing that you have to keep in mind is that liquidity is going to be a little bit of an issue, so you have to keep that in the back of your head as well. I do prefer the US dollar over the South African rand, but I will follow the market in whichever direction it goes. There does seem to be a bit of US dollar shortage out there right now, and that plays havoc with emerging market currencies such as the South African rand.