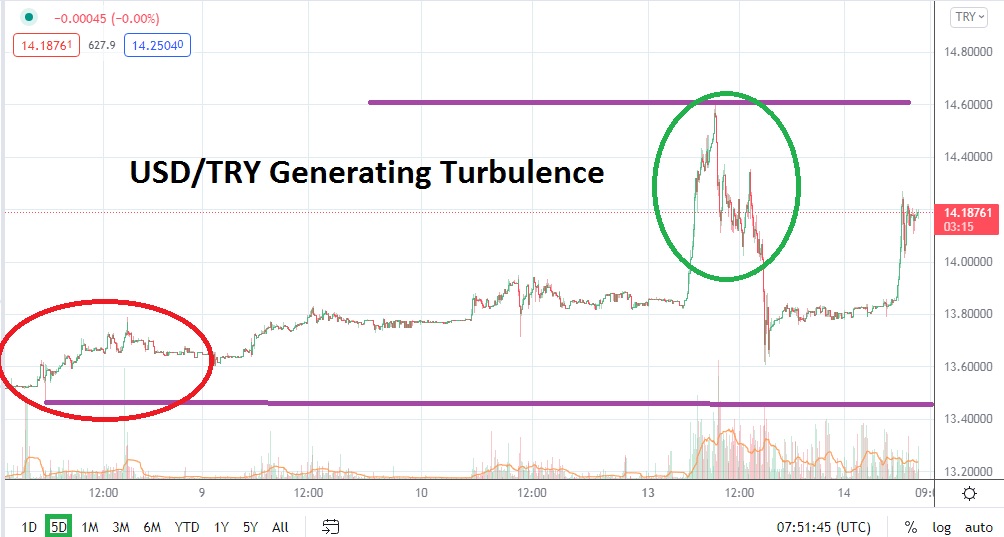

The USD/TRY has seen additional waves of volatility strike in the last day as the Forex pair has generated profound trading turbulence. A swift short-term apex yesterday saw the 14.61000 level hit, which was then followed by a reversal lower to nearly 13.60000. Since then the USD/TRY has ‘recovered’ some stability and is trading around 14.17000 as of this writing. Traders need to anticipate more volatility in the coming days.

The notion the USD/TRY is trading above 14.00000 a couple of months ago may have seemed like an insane forecast. It needs to be remembered that on the 15th of September the USD/TRY was around a value of 8.40000. The economic reality the USD/TRY has lost almost 40% of its value in the past three months doesn’t just affect Forex traders, it affects citizens and business within Turkey also. Misguided fiscal policy from within the nation by its leadership has created a crisis for the USD/TRY.

Technically the USD/TRY needs to be treated with caution if it is being pursued as a speculative wager. It is encouraged that entry price orders are used to ignite trading positions that meet starting point expectations. Having seen a wicked flurry of trading develop yesterday when the USD/TRY broke above the 14.00000 for the first time caused bedlam. Traders need to use take-profit and stop loss ratios religiously to guard against the potential from additional USD/TRY trading violence.

As the USD/TRY trades around the 14.17000 vicinity early this morning, traders should look to see if values are sustained above the 14.00000 juncture consistently. If this level is sustained it may signal an additional level of skepticism within the USD/TRY is developing which could indicate additional bullish price action will ensue.

Speculators who want to buy the USD/TRY need to ask their brokers about the cost of transaction fees within the pair. While quick trading results may certainly be wanted, traders may have to entertain the notion of carrying the pair overnight which may have additional costs too.

Buying the USD/TRY remains the logical speculative wager. This should be done with a conservative amount of leverage and realistic goals. Price fluctuations may prove to be rampant within the USD/TRY. Buying the USD/TRY on slight dips by using an entry order below current market prices in order to initiate a long position may be a correct way to pursue potential upwards momentum.

Turkish Lira Short-Term Outlook

Current Resistance: 14.37000

Current Support: 14.05000

High Target: 14.69000

Low Target: 13.73000