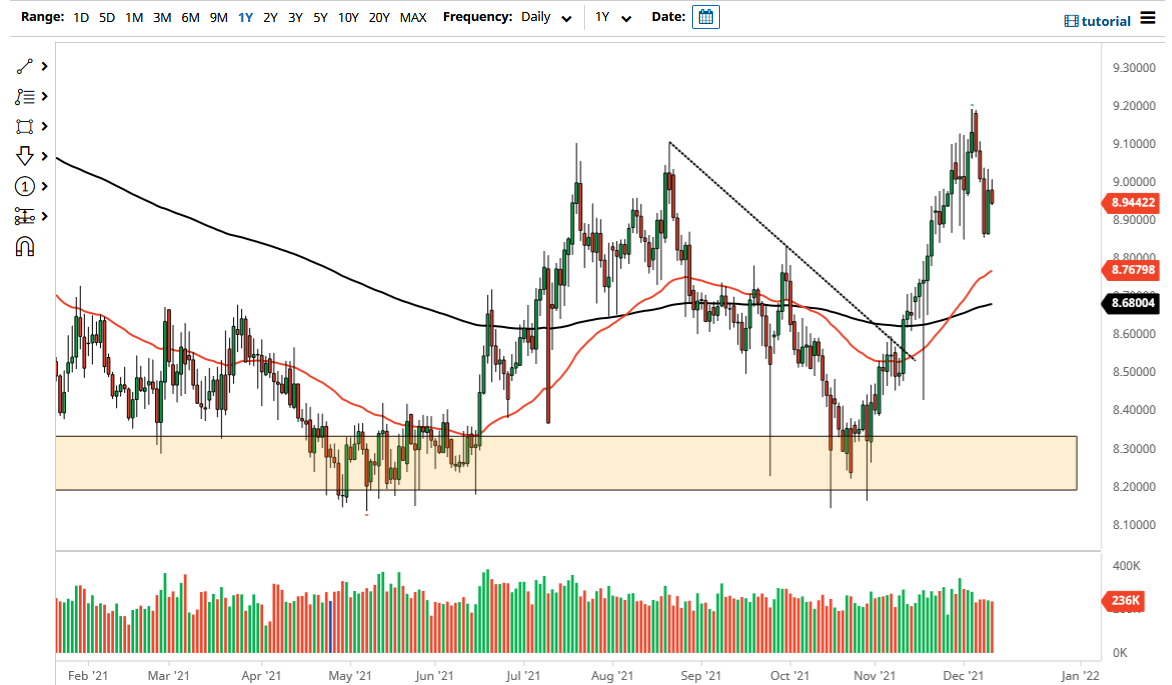

The US dollar initially tried to rally on Friday as we approached the 9.0000 NOK level. This is a large, round, psychologically significant figure, so a lot of people will be paying close attention to this region. With that being the case, I think we could get a little bit of a pullback towards the bottom of the recent consolidation at the 8.85 NOK level. Nonetheless, a lot of this is going to come down to whether or not crude oil can get moving, because if we can break down below that level, then we could really start to see the Norwegian krone take off.

Keep in mind that the Norwegian krone is highly levered to the crude oil market, so we will have to pay attention to what happens over there. It does look like oil is trying to recover a bit, so it is worth paying close attention to what happens in that market. The more it rallies, the more likely this market is to break down.

To the upside, if we were to break above the 9.03 NOK level, then it is likely that we could go looking towards the 9.17 NOK level. You can see that we had an explosive move to the upside over the last couple of weeks, which does make a certain amount of sense considering that it is a relatively small market, so it does move quite rapidly with crude oil. While there are other things to worry about such as interest rates in both Norway in the United States, the reality is most Forex traders simply use this currency to express some type of view on petroleum.

Whether or not this is trying to front run the crude oil market or not is a completely different question, but it is obvious to me that the 8.85 level is an area that has been rather resilient, so slicing through that would allow a move down to at least the 50-day EMA at the 8.76 handle. To the upside, things are a little murkier, as we have seen a lot of wicks form right around that 9.0000 level. Keep in mind this pair is choppy, but it does trend quite nicely over the longer term, so think of this more in the context of holding it in one direction or the other for a couple of weeks, not a short-term trade.