Concerns in Asia about the economic situation in China calmed a bit, leaving room for risk appetite. The USD/JPY currency pair returned to correct upwards, reaching the resistance level of 113.95. The pair has been trying to rebound higher since the beginning of this quiet week's trading. So far, the currency pair lacks stimulus factors to make a bullish trend reversal, as the pair succeeded in moving towards the 115.52 resistance at the end of trading last month, its highest level in years. Since the announcement of the South African Omicron variant and the quick decisions of countries around the world to lock down, the traditional safe haven Japanese yen has made strong gains against the rest of the other major currencies.

In addition to the epidemic, global geopolitical anxiety has increased, and the world is watching what US President Joe Biden is doing to convince Russian President Vladimir Putin of the need to retreat from the escalation of tensions on the Russian-Ukrainian border? The answer to this question can determine whether the acute geopolitical risk escalates to a full-fledged military invasion by Russia.

For the US dollar, such a development could provide material support in the new year according to analysts.

US President Joe Biden told Russian President Vladimir Putin in a phone call on Tuesday that Russia and its banks could face the harshest economic sanctions if Russia invades Ukraine. In a statement after the meeting, Putin's office confirmed that Biden addressed "the movements of Russian forces near the Ukrainian border and outlined the sanctions that the United States and its allies would be ready to impose if the situation escalated further." Biden was said to have referred to the movements as "threatening."

Putin, in turn, warned "against transferring responsibility to Russia, since it is NATO that is making dangerous attempts to gain a foothold on Ukrainian territory." The United States is said to be pressuring Germany to shut down Russia's Nord Stream 2 gas pipeline as part of a package of sanctions that would be implemented in the event of an invasion. Commenting on this, Philip Wei, chief currency economist at DBS Bank, said: “The geopolitical landscape will be uncertain and unpredictable in 2022. Some of the risks include a possible Russian invasion of Ukraine.”

Biden's call with Putin comes amid rising tensions over the buildup of Russian military assets on the Ukrainian border. The developments are an emerging geopolitical concern for forward-looking investors: despite judging by the return of euphoric sentiment on December 7, the issue has yet to become mainstream. But analysts note that.

“The Swiss franc is not weaker,” says Daraj Maher, HSBC forex analyst. “Maybe it makes the European postcode for the Swiss franc more in line with the rising geopolitical tensions between the US/Europe and Russia over Ukraine.” Also, Valerie Bernstein, an analyst at Citibank, says that although she initially thought Russia was unlikely to take action on Ukraine, she now believes that these developments give cause for concern.

There are now nearly 90,000 Russian soldiers massed along the Russian-Ukrainian border, along with tanks and artillery. US military intelligence officials have reportedly told President Biden that there is a possibility that 175,000 Russian soldiers were involved in the invasion of Ukraine. "Russian plans call for a military attack on Ukraine as early as 2022 with a scale of forces twice what we saw last spring during Russia's surprise exercises near Ukraine's border," an administration official told the Washington Post.

For the dollar, which benefits from higher liquidity in times of deteriorating market sentiment, the development supports a potential upward trend. Analysts are of the view that it will be difficult to achieve a reversal of the bullish trend in the US dollar without a healthy and synchronized global recovery. Also, a global recovery is unlikely given the rising geopolitical risks in Eastern Europe, combined with the slowing Chinese economy and the unwelcome emergence of the highly hostile Omicron Covid-19 variable risk.

DBS predicts that it will only be in 2023 when the US dollar will depreciate as US GDP growth shifts below 3%.

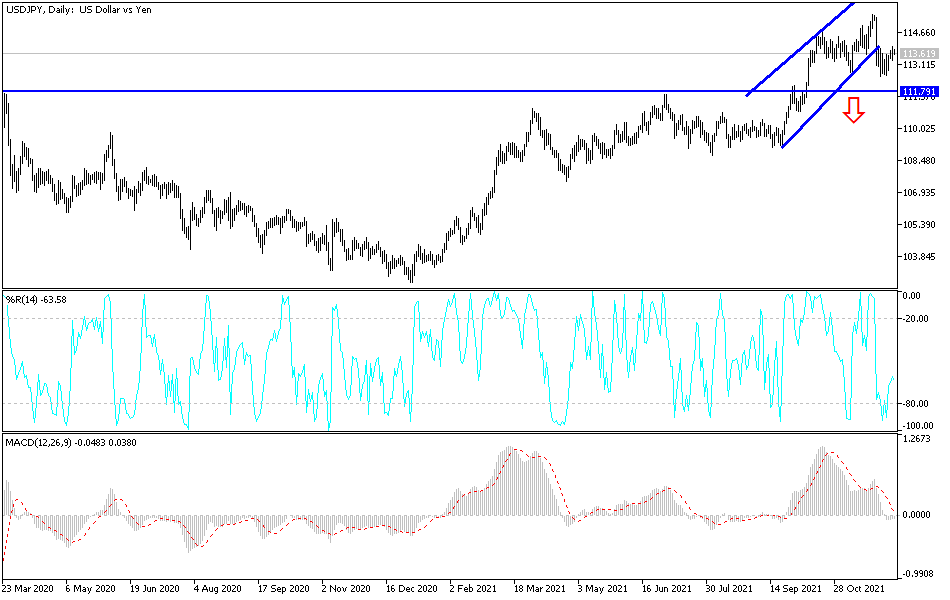

Technical Analysis

On the daily chart, it is clear that the USD/JPY pair's performance is neutral and the pair is trying to stop its losses so as not to increase the strength of the downtrend, which was close to testing the 112.00 support. I still prefer selling the USD/JPY pair at each resistance level, the closest of which are 114.20 and 115.00. A move towards the 112.50 support would confirm the bearish trend and stimulate the bears to launch further downward. The currency pair may remain in a narrow range until the release of the US CPI reading for the Forex market this week.