The attempts of the bulls to control the USD/JPY culminated in a test of the 115.00 psychological resistance level, where it has settled as of this writing. This was the highest for the currency pair in more than a month. Investors' risk appetite has helped the currency pair a lot in achieving its recent gains. The US dollar is still strongly supported by expectations of an imminent date for raising US interest rates. The US economic recovery from the effects of the epidemic is still strong.

The US dollar recovered from the profit-taking after the FOMC largely confirmed market expectations of a weekly advance against all major currencies and most emerging market currencies. Also, the omicron variant continues to spread around the world, and efforts in large parts of Europe and the United States to persuade employees to return to offices have waned. Growth fears and the confirmation of a hawkish trend by the Federal Reserve weighed on the dollar currencies.

Recently, investors have become more comfortable with the omicron variant of the coronavirus in the past two weeks. The rapidly spreading virus appears to be less dangerous and causes fewer deaths and hospitalizations than other versions of the virus. Much remains uncertain about omicron, which is spreading very quickly and leading to a return to restrictions in some places. The variant soon became the dominant breed worldwide.

While lockdowns and travel restrictions related to the virus remain a major concern, most major investors have closed positions for 2021 and are likely to continue operating until next week. Trading this week was sluggish, with fewer than 3 billion shares traded on the New York Stock Exchange in the past two days, compared to the 4.5 billion shares typically bought and sold on average per day.

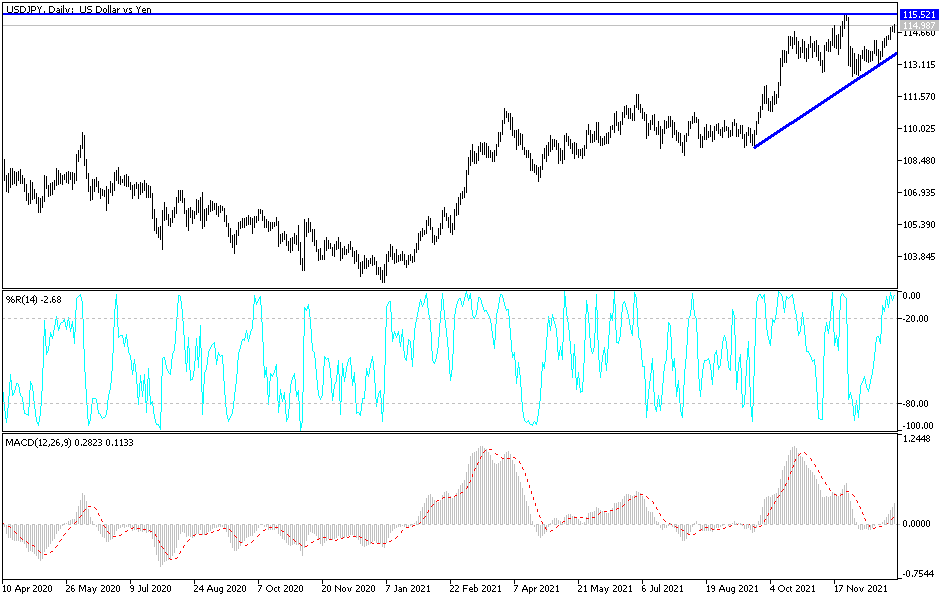

Technical Analysis

The movement of the bulls towards the 115.20 resistance is currently pushing the technical indicators towards strong overbought levels, and offering selling opportunities. This week’s movements are not a measure of the market in general due to the holidays, poor liquidity and reluctance of investors. Global restrictions to contain the epidemic weaken the future of the global economic recovery, and thus investors may return to safe havens, such as the JPY.

On the downside, the support levels 114.10 and 113.35 are the most important for the bears to regain control of the performance again.

The currency pair will be affected today by risk appetite or lack thereof, as well as the reaction to the US weekly jobless claims and the Chicago PMI reading.