Since the start of this week's trading, the USD/JPY has been moving within attempts to rebound upwards, reach the 113.78 resistance and settling around 113.50 as of this writing. This came after the announcement of growth figures for the Japanese economy, and no important US data. The US dollar is still supported by expectations that the US interest rate will be raised soon. Federal Reserve Chairman Jerome Powell, in testimony to US lawmakers last week, said he no longer sees inflation as temporary, and the possibility of an accelerating "gradual taper" could be announced at the US Federal Reserve's December meeting.

The US trade deficit narrowed to $67.1 billion in October, the lowest level in six months, after hitting a record high in September. A significant rebound in exports helped offset a much smaller increase in imports. In this regard, the US Commerce Department reported that the October deficit was 17.6% below its all-time high in September at $81.4 billion. It was the smallest monthly deficit since the $66.2 billion imbalance in April.

Economists see the strong rebound in exports as evidence that global supply chains are beginning to disintegrate, and believe that smaller deficits this quarter could give a boost to overall US economic growth. There were gains in many export categories, indicating that the recovering global economy is beginning to boost demand for US products. Americans' demand for imports was racing ahead of export sales as the US economy recovered more quickly than other countries from the pandemic.

In October, exports rose 8.1% to $223.6 billion while imports rose 0.9% to $290.7 billion. A deficit is the gap between what the United States exports to the rest of the world and the imports it buys from foreign countries. The politically sensitive trade deficit with China, the largest with any country, fell 14% in October to $31.4 billion. In the first 10 months of this year, the goods trade deficit with China was 13.7% higher than it was a year ago.

America's total trade deficit is $705.2 billion so far this year, up 29.7% from the same period last year. Trade flows were sharply reduced last year as the COVID pandemic curtailed economic activity.

Part of the October increase in exports reflected an increase in oil exports, reflecting the return to more normal operations at Gulf Coast refineries that had been closed by Hurricane Ida. Big gains in US auto exports and imports suggest that the global shortage of computer chips that has hampered auto production is beginning to recede, a trend that leaders in the auto industry have noted.

Commenting on the results, Andrew Hunter, chief US economist at Capital Economics, predicted that the improved business picture would add about one percentage point to US economic growth in the current October-December quarter. It expects GDP to grow at an annual rate of 6.5% this quarter, a significant improvement from the modest 2.1% growth rate in the third quarter.

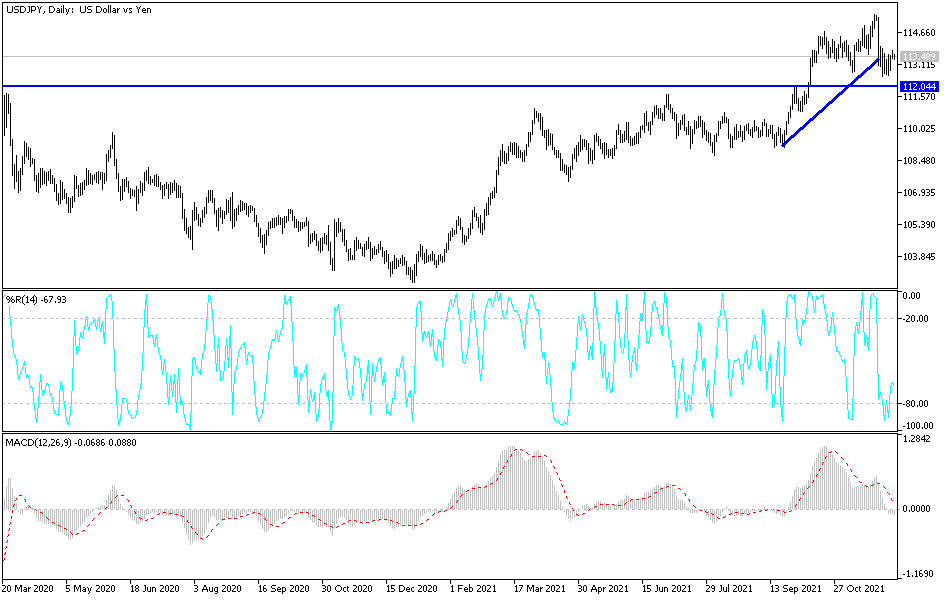

Technical Analysis

As I expected, the USD/JPY will continue to move in narrow ranges until the US inflation figures are announced. The psychological resistance is still 114.00 and is crucial for the bulls to continue moving upward. So far I still prefer to sell the currency pair from every bullish level. There is still a break in the trend on the daily chart and the neutrality of performance in the recent period is due to the markets’ loss of catalysts for a higher launch, as the world is still studying the effects of the new COVID variant and its resistance to approved vaccines and the absence of influential US data since the beginning of the week's trading.

To the downside, breaking the 113.00 support will give the bears the motivation to move back, and accordingly, the next support levels may be 112.25, 111.40 and 110.80.