The US dollar crosses got more bullish momentum after the Federal Reserve announced that it would end its asset buying campaign in March and then start raising interest rates soon after. Accordingly, the price of the USD/JPY currency pair moved towards the resistance level at 114.27 before settling around the 114.15 level as of this writing, waiting for any news.

The Federal Open Market Committee (FOMC) plans to end its monthly bond-buying program in March. The US central bank also plans to pull the trigger three times to raise interest rates in 2022. According to a statement from the Eccles Building, the institution will receive $60 billion in bonds each month starting in January, half of what it had before the announcement. Once the pandemic-era quantitative easing program ends, the Fed will start raising US interest rates. The Fed expects up to three rate increases next year, two in 2023 and two more in 2024.

When assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of the information received on the economic outlook. The Committee will be ready to adjust the monetary policy stance as necessary if risks arise that may impede the achievement of the Committee's objectives.

In the announcement, the pricing committee said the committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures, inflation expectations, and financial and international developments.

In response to the announcement, US Treasury market yields were stronger, with the 10-year bond yield rising to 1.462%. One-year yields rose to 0.287%, while 30-year yields jumped to 1.84%. Also, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of other major competing currencies, rose to 96.76, and the index added to its massive gains since the beginning of the year 2021 to date by 7.5%.

The White House insisted there was no need for a shutdown because vaccines are widely available and appear to provide protection from the worst consequences of the virus. But even if Omicron proves to be generally milder than Delta, it may disarm some of the available life-saving tools and put the immunocompromised and the elderly at particular risk when it launches a rapid attack on the United States. Globally, more than 75 countries have reported confirmed cases of oomicron. In the United States, 36 states have detected the variant.

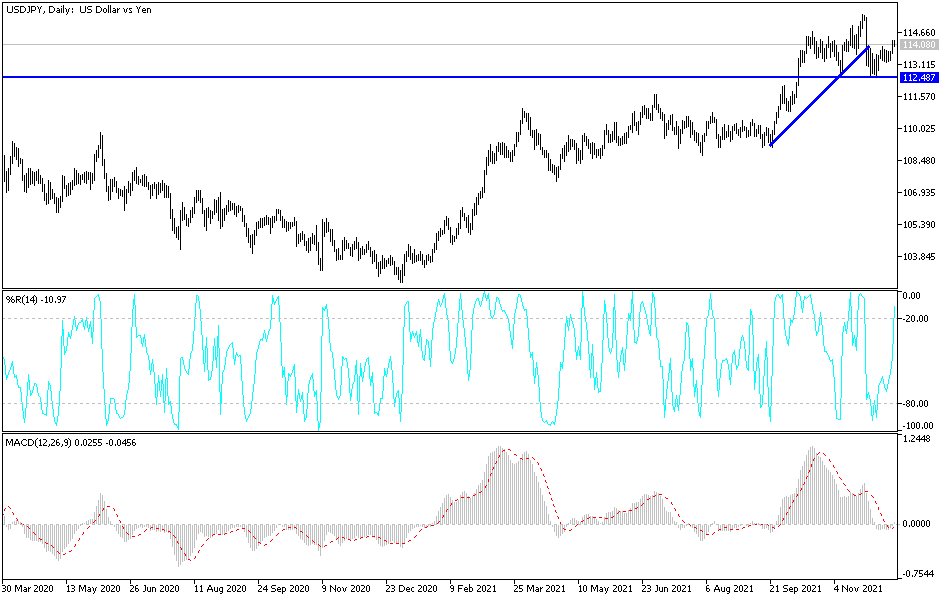

Technical Analysis

We have been saying that the 114.20 resistance level is crucial to continue a bullish outlook after a period of neutral stability in the recent trading sessions. More strength will return the currency pair to its bullish trend on the daily chart, which paves the way for stronger gains, the closest of which are currently 114.85 and 115.50. I still prefer selling the currency pair from every bullish level. On the same time period, in order for the general trend to be bearish, it is necessary to move towards the 112.00 support. The US dollar will be affected today by the announcement of the number of weekly jobless claims, the reading of the Philadelphia Industrial Index, housing data and industrial production.