The US dollar remains strong in the Forex market as investors begin to flock to traditional safe-haven assets amid an ocean of red ink in global financial markets. Financial markets and investors are cautiously waiting for the Federal Reserve's critical policy meeting in December, which may determine the directional path for 2022. In the case of the USD/JPY currency pair, it is settling around the 113.80 resistance as of this writing, amid an upward momentum since the beginning of this week's trading.

The Fed will end on Wednesday the Federal Open Market Committee's (FOMC) two-day policy meeting. The Fed is widely expected to leave US interest rates unchanged, but is announcing two major developments. According to a new CNBC Fed survey, experts believe the Fed will halt asset purchases in March and start raising interest rates in June. Commenting on this, Stephen Blitz, chief US economist at TS Lombard, said: “The US economy has jumped far ahead of Fed policy rates.”

But would a 25 or 50 basis point rate hike be enough? This is the question being debated on Wall Street as the many price pressures affect the US economy, from employment costs to energy prices to fiscal expansion.

On the data front, wholesale prices are up in November, with the annual producer price index rising to 9.6% last month, above the average estimate of 9.2%. On a monthly basis, the producer price index advanced 0.8%. It was the highest monthly reading in four months. The 12-month increase in wholesale inflation set a new record, outpacing the old 12-month records of 8.6% increases recorded in September and October. Wholesale price records go back to 2010.

Core inflation at the wholesale level, which does not include volatile food and energy, rose 0.8% in November with core prices rising 9.5% over the past 12 months. The increase in wholesale prices was broad-based, led by a 1.2% rise in the cost of goods and a 0.7% rise in services prices. The rise in wholesale prices followed news on Friday that US consumer prices jumped 6.8% in the 12 months to November, the largest increase in 39 years, as prices for energy, food and many other goods rose.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, jumped to 96.45, from an opening at 96.32. The index has increased by 7.25% since the beginning of the year 2021 to date.

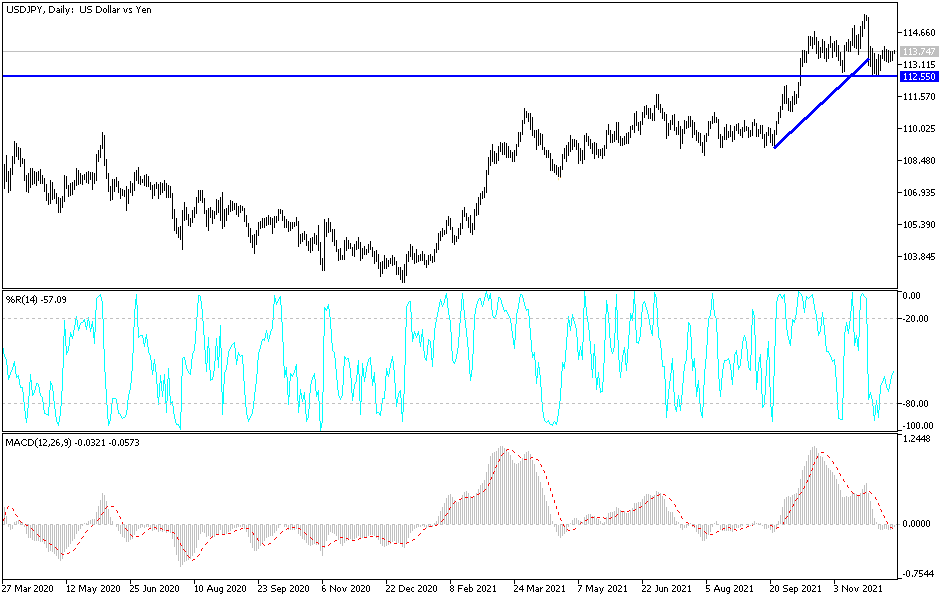

Technical Analysis

On the daily chart, the USD/JPY is trying to launch to the 114.20 resistance area to return to its bullish channel on the chart and to avoid the continuation of the last breach of the channel. The pair is close to testing the 112.00 support, which is crucial to making the general trend bearish. Whatever the decisions of the Fed, selling the currency pair from every bullish level will remain the best. There are other factors that motivate investors to buy safe havens, and the Japanese yen is one of the most important safe havens.

So far, there is neutrality in the performance, and one of the two directions needs stronger catalysts. There is nothing more important than what will be announced today for this to happen, so caution must be exercised.