The outlook for the US dollar was boosted last Friday when official figures confirmed US inflation had risen to a new multi-decade high last month, which is likely to keep the Federal Reserve (Fed) on course to accelerate its monetary policy normalization. The price of the USD/JPY currency pair moved towards the level of 113.80 after the data and settled around the level of 113.46 as of this writing. The US dollar's exchange rates fluctuated briefly before the weekend as figures from the Bureau of Labor Statistics revealed that a 0.8% US inflation increase in November lifted the annual pace of price growth in the US to 6.8% last month.

Meanwhile, inflation rose from 4.6% to 4.9% for November, the highest level since the year ending June 1991, even after excluding changes in volatile food and energy prices from the figures after a 0.5% increase in November in core inflation. Gasoline, housing, food, used cars and trucks and new vehicles were among the biggest contributors to the price increases in November, all goods whose supplies were recently disrupted by efforts to contain the Corona virus, which has led to prices rising sharply over the past year.

Catherine Judge, CIBC Capital Markets economist, says: “With inflation at a high pace, the Fed is expected to accelerate its quantitative easing schedule at the December meeting, to end in early spring, and to allow for a rate hike in the second quarter of 2022, when the winter wave of Covid is late for us.”

Inflation has risen sharply around the world this year due to shortages of goods and labor as well as other factors, although price increases have been stronger in the United States where publicly funded financial support for households was much greater than elsewhere at the height of the pandemic. November was the second consecutive month that the headline CPI rose more than six percent, well above the Fed's average inflation target of 2 percent and likely to keep the bank on track to accelerate the normalization of its monetary policy settings.

The strength and persistence of recent increases in inflation have led Fed policy makers to rethink earlier expectations that price pressures would quickly dissipate on their own, and they almost cut the bargain for a decision this week to speed up the process of winding down the bank's bond-buying program.

Ten of the twelve FOMC voting members have publicly indicated over the past month that they might support a decision to scale back the Fed's monthly bond purchases at a faster pace than agreed in November. Many economists now expect the Fed to end its bond purchases in March instead of June 2022, which would provide room for the bank to start raising its key rate as soon as possible in the second quarter of next year if inflation pressures remain high enough in the interim.

Technical Analysis

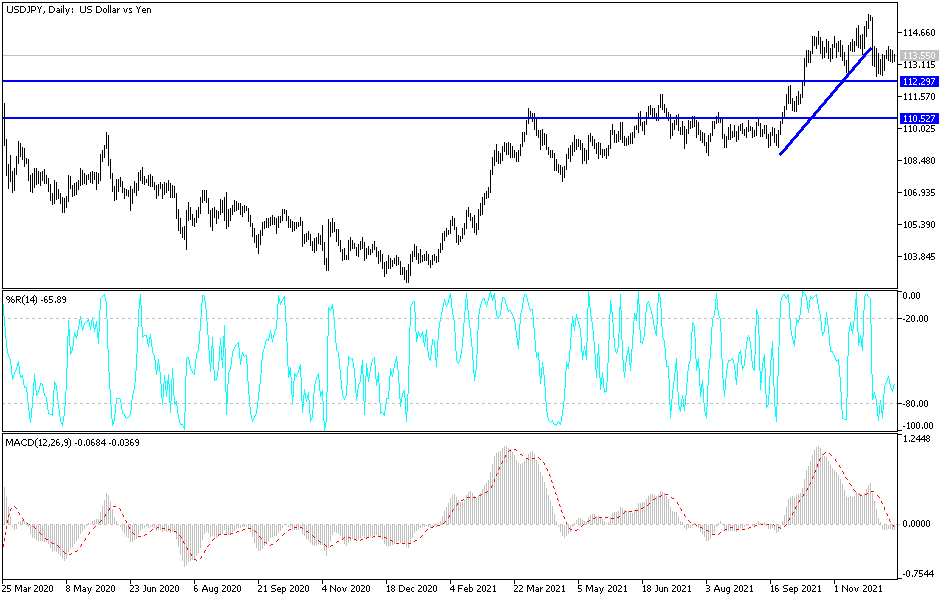

How the USD/JPY will close out this year will depend on what will be issued by the US Federal Reserve this week. So far, the currency pair is in a neutral position with a bearish bias, and stability below the 113.00 support will increase the bears' control to move further downwards. According to the performance on the daily chart, the next bearish targets will be 112.50, 111.75 and 110.60.

On the upside, and according to the performance over the same time period, the 114.20 resistance will be important for the bulls to launch further and change the current situation. In addition to the raising of interest rates, it is necessary to take into account the extent of risk appetite.