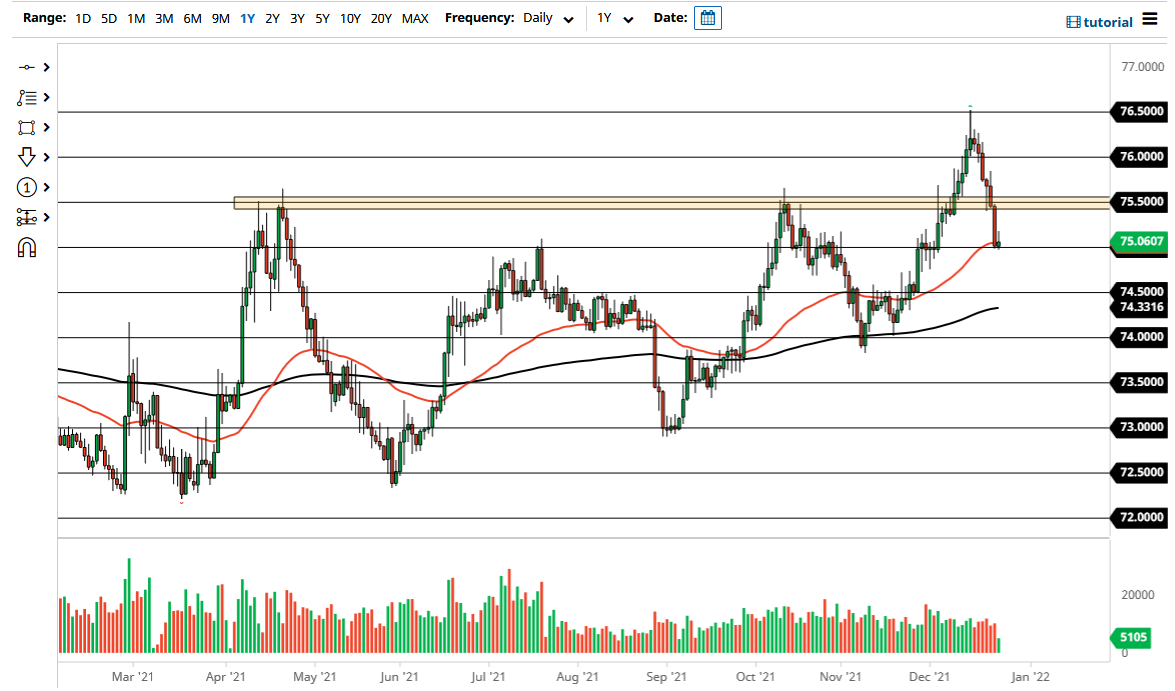

The US dollar rallied a bit on Friday but gave back the gains to form an inverted hammer. We are sitting right at the ₹75 level, which is also where we have the 50 day EMA. We have seen this pair fall apart recently, and now that we are stabilizing a bit, it will be interesting to see whether or not we can bounce enough to break the top of this inverted hammer. If we do, then it is likely that we could go looking towards the ₹75.50 level.

On the other hand, if we break down below the bottom of the inverted hammer on Friday, then we will more than likely drop from here to go towards the ₹74.50 level, where the 200 day EMA is rapidly approaching. One thing is for sure: the pair has fallen rather hard, but I would point out the fact that this pair does tend to be very choppy and make huge moves. The Friday candlestick was a bit of a binary candlestick, so I will trade in either direction; I'm just waiting for the market to tell me which way it wants to go.

Looking at this chart, I can see that we tend to zigzag all the way from extreme lows to extreme highs, so it would not be a real stretch to see this market turn around and take off to the upside again. A lot of this will come down to risk appetite, as the US dollar is considered to be a safety currency. However, recently we have seen more oil demand coming out of India, which does suggest that the economy is picking back up, so it does make a certain amount of sense that we have seen this massive pullback. If that keeps up, then we could go much lower, but right now I am only looking at ₹74.50 to the downside. I do think that the 200 day EMA will probably cause at least a little bit of a hesitation. On the other hand, if we break above the top of the inverted hammer, that is normally one of my favorite set ups, because it shows resiliency and tenacity by the bulls to push the market to the upside even further.