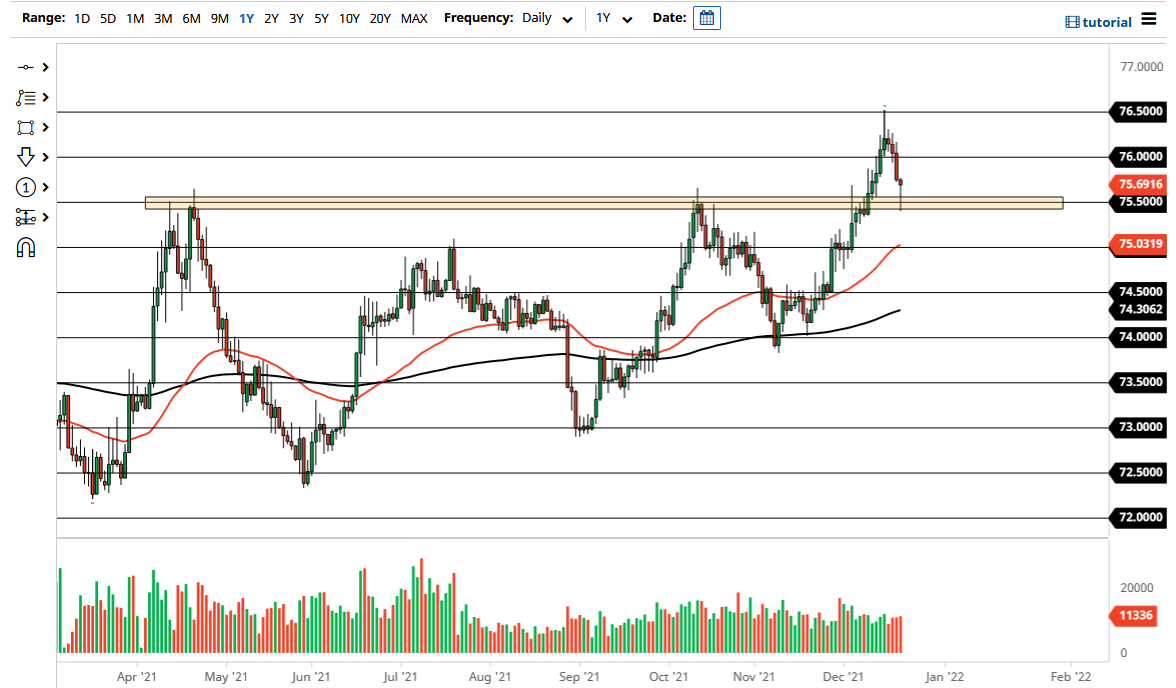

The US dollar fell rather hard on Tuesday to crash into the ₹75.50 level. However, we have turned around to bounce quite significantly and formed a nice-looking hammer. This was an area that was always going to be important, due to the fact that it was previously major resistance. Now that we have broken out and then pulled back to test this area again, it does make a certain amount of sense that buyers will step in and try to take advantage of this.

That being said, if we were to break down below the ₹75.50 level then we could see a significant selloff. At that point, I think it would probably start sending this pair much lower. The market continues to see more of a “buy on the dip” mentality, and I think that will play out ultimately. This is a market that, given enough time, may go looking towards the ₹76.50 level, which is where we recently made the highs. Breaking above that then sends this more into a “buy-and-hold” type of situation.

The market will more than likely continue to see a lot of noise more than anything else, but it does look like we are more likely than not to see buyers step in. Keep in mind that this pair does not move quickly most of the time, as it is somewhat manipulated by the RBI. The Indian rupee is an emerging market currency, so that is something that needs to be paid close attention to, and certain things like coronavirus figures will have a major effect on these currencies. Furthermore, we are heading towards the end of the year, so liquidity could be an issue, and that is going to be especially true when it comes to exotic Forex pairs.

Keep your position size reasonable, but look at this through the prism of a longer-term trade. Quite frankly, the Indian rupee is not a currency that you day trade, rather it is built for swing trading more than anything else. The 50-day EMA currently sits just above the ₹75 level and is approaching, so that could offer even more support down the road as it continues to elevate itself. The US dollar itself has been rather strong against most currencies, so it will be especially so against this one.