The US dollar initially pulled back just a bit on Tuesday but ended up reversing 30 pips against the Indian rupee to close out the session just below ₹75.50. Traders have continued to flock to the US dollar in general, especially when it comes to emerging market economies. India has special concern due to the coronavirus variant known as omicron, as India had been so hard-hit by coronavirus previously. If that variant were to take hold of India, the fear is that it would shut everything down.

Because of this, people would bet against the idea of India in general and run towards the US dollar for safety. Furthermore, keep in mind that a lot of what drives the Indian rupee is international investment, and that has a major influence on monetary flows in general. Quite frankly, if we continue to concern ourselves with a potential shut down in a country that does not have a medical system to deal with omicron, then this pair will explode.

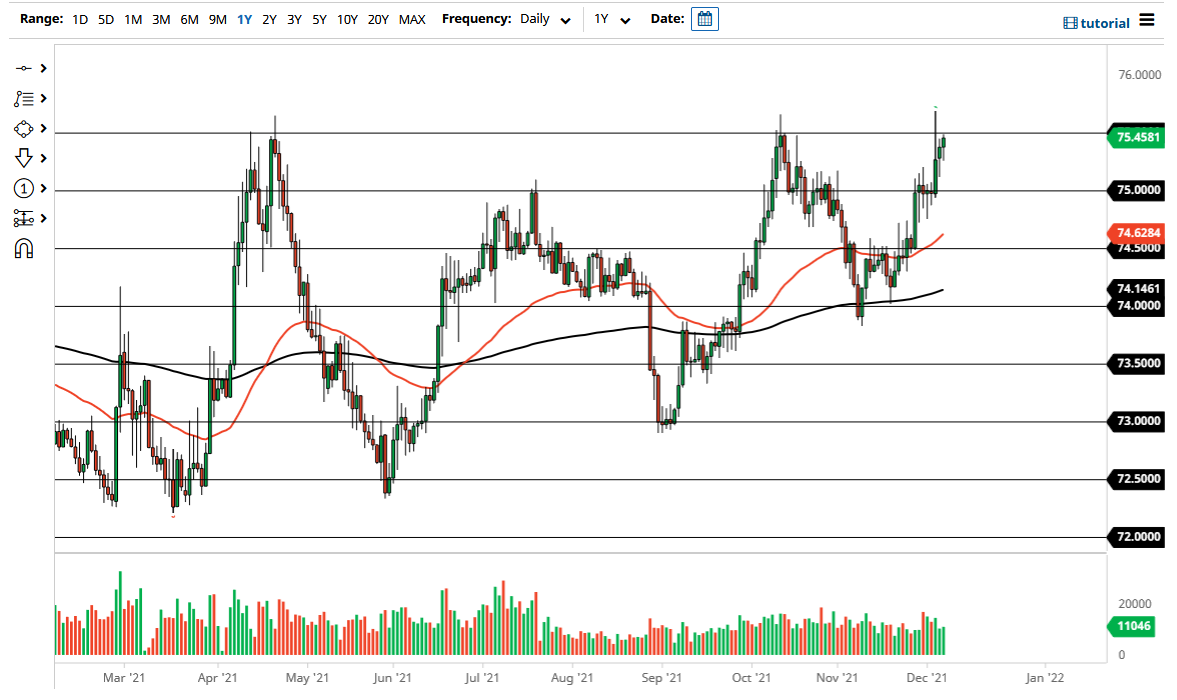

Looking at the longer-term technical analysis, it should be noted that the pair does tend to move in ₹0.50 increments, and the fact that we are sitting at the ₹75.50 level suggests that there should be a certain amount of psychological resistance anyway. Notice that we spiked during the Friday session, and it is possible that we could go looking towards the top of the candlestick again. If we do break that candlestick to the upside, it is very likely that we will go running towards the ₹76 level. To the downside, the ₹75 level should be supportive, as we had seen so much chopping around in that general vicinity.

When you take a look at the overall chart, it is not a huge surprise that we have been rallying yet again, because the structure of the market is almost like a massive ascending triangle. Quite frankly, if we were to break to the upside you could make a technical analysis argument for a 3 big figure move, which is rather big for this type of market. That does not mean that it would have to happen very quickly, but that would be your long-term forecast. It certainly looks as if we are about to make a big move.