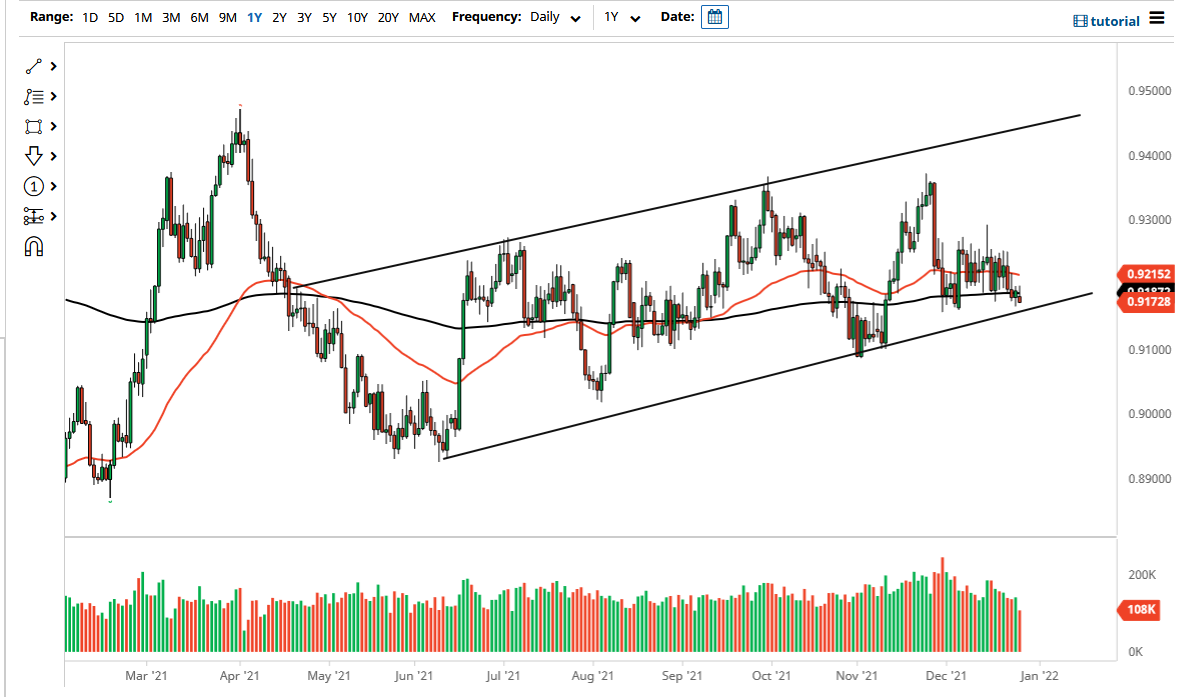

The US dollar did very little over the last 24 hours against the Swiss franc, which should not be a huge surprise considering that we are between Christmas and New Year’s Day. We are also hanging about the 200 day EMA, which does tend to attract a lot of attention anyway, so all that hanging out together makes quite a bit of sense that we would be a little lackluster in our movement. When you look at this chart, you can see that I have drawn a huge channel, and we are getting relatively close to the bottom of it. Because of this, I believe that it is probably only a matter of time before we rally for some type of supportive action, but right now I do not have that trigger.

Recently, a lot of Forex dealers have been warning about the Swiss National Bank possibly intervening in the Forex markets, driving down the value of the Swiss franc. That being said, it never happened, so I think that is now in the rearview mirror. When I look at this chart, I see a clear range between 0.9150 and 0.9250. Remember that this pair does tend to be very grinding and range-bound and is not exactly one that people trade for excitement. It is also the antithesis of the EUR/USD pair, so as that goes higher or lower, typically this pair will go in the opposite direction.

I suspect that the next week or so is probably going to be very choppy and sideways, so I am not looking for much in the way of motion. That being said, I am favoring the upside overall, at least until we would break down below the 0.9150 level. To the upside, if we can break above the 0.93 level, then I think the dollar has a real opportunity to go looking towards the 0.94 handle, but you must keep in mind that this pair tends to chop and grind, meaning that you have to be patient to collect your profits. If nothing else, you can use this as an indicator on how to trade the Swiss franc against other currencies, because it can give you a bit of a “heads up” on relative strength when it comes to the Swiss franc.