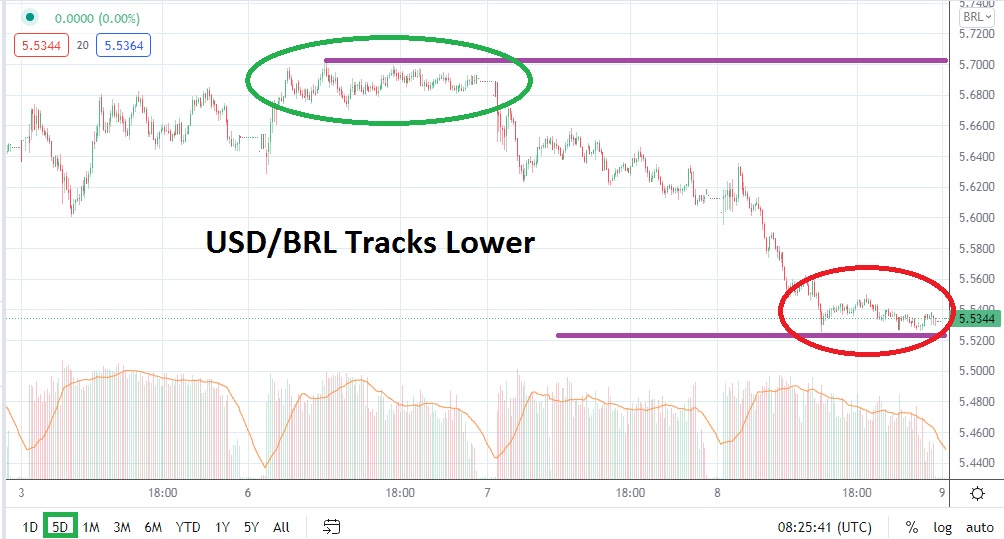

In what appears to be a risk-on attitude in the global markets, the USD/BRL has responded the past couple of days with a sudden bearish trend which has tracked to within sight of intriguing support levels. When the USD/BRL opens for trading today, speculators may want to allow the Forex pair to trade momentarily before placing their positions in order to gauge the technical reaction to yesterday’s rather strong selling momentum.

Having achieved a high of nearly 5.7000 on Monday, the USD/BRL responded with a sudden surge of downward price action. While the trading was not fast, Tuesday’s value range was able to sustain the slight movement downwards and then a more rapid pace of selling ensued.

While closing near the 5.6030 price on the 7th, trading opened higher yesterday briefly and a high of nearly 5.6400 was attained. However, after touching this short-term height a reversal lower began to be demonstrated. When the 5.6000 mark was proven vulnerable, the USD/BRL began to see quick price velocity lower and traded near the 5.6250 ratio before rising slightly as the day’s trading ended.

When technical charts with a longer-term perspective are studied, the USD/BRL can be considered to be still within the higher part of its price range. The 5.5000 level for the USD/BRL has proven to be an important inflection point for the pair since late in August of this year. It appears this level may be acting as equilibrium that financial institutions may perceive as ‘fair value’ in the mid-term. Today’s opening and trading results will provide an interesting test of short-term sentiment.

If global markets via the major equity indices continue to provide bullish action, traders may perceive the USD as still being overbought within many major Forex pairs near term. The USD/BRL has a habit of not always correlating to global Forex conditions, but it is certainly affected by behavioral sentiment. The past two days of trading within the USD/BRL has shown a bearish trend which signals healthy trading conditions.

Speculators who are tempted to sell the USD/BRL on slight rises in value while looking for downside price action may prove to be correct. The support levels of 5.5200 to 5.5100 will be important in early trading today and if proven vulnerable the USD/BRL may see additional selling action sparked.

Brazilian Real Short-Term Outlook

Current Resistance: 5.5475

Current Support: 5.5180

High Target: 5.5810

Low Target: 5.4860