The US dollar initially fell against the South African Rand during trading on Thursday but has bounced quite significantly to break back towards the 16 Rand level. That is a large, round, psychologically significant figure so it does make a certain amount of sense that we will pay close attention to it. Beyond that, the US dollar is strengthening against a lot of emerging market currencies, not just this one. Finally, the omicron variant coming out of South Africa has people pulling money out of that country as a lot of travel has been restricted from there. Because of this, I think the South African Rand probably gets punished.

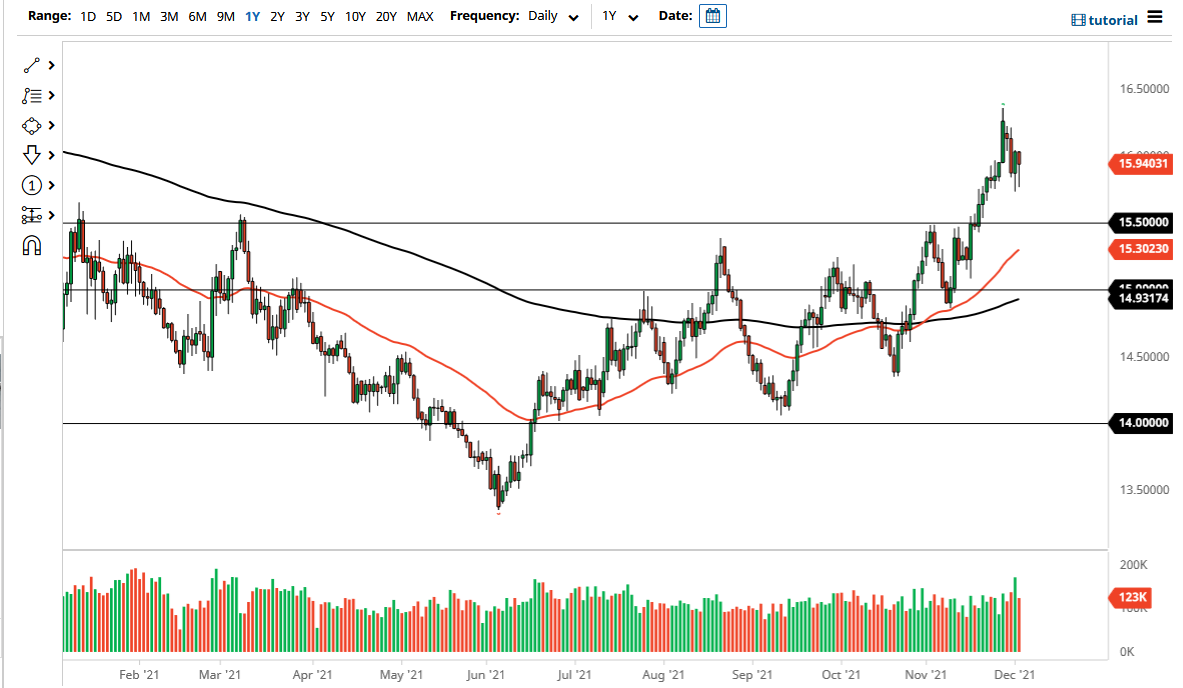

The jobs report comes out of the United States on Friday, so this of course will have a major influence on the greenback as well. Ultimately, I do think that this pair continues to go higher, because the breakout from the 15,000.50 Rand level was a very strong signal, and we recently had the “golden cross” that came into the picture as well. With this being the case, the market is likely going to continue to see a lot of noisy behavior, but nonetheless I do think that we have further to go to the upside.

If supply chains continue to be disrupted, money flows into the US bond market, which of course demands US dollars as well. As long as that is going to be the case, emerging market currency such as the Rand will be sold off. Another thing to pay close attention to is the fact that the market is in an uptrend anyway, so therefore I do not have any interest in trying to short this market. In fact, it is not until we break down below the 50 day EMA, currently sitting at the 15.30 Rand level that I would consider trying to fade this rally.

The volatility during the day on Friday is hopefully going to send this pair lower so I can buy it at a better price. However, a strong jobs report may send this market screaming to the upside. Furthermore, we will have to pay close attention to the entire situation when it comes to the coronavirus and South Africa, because the market seems to be in a “sell first and ask questions later” type of situation.