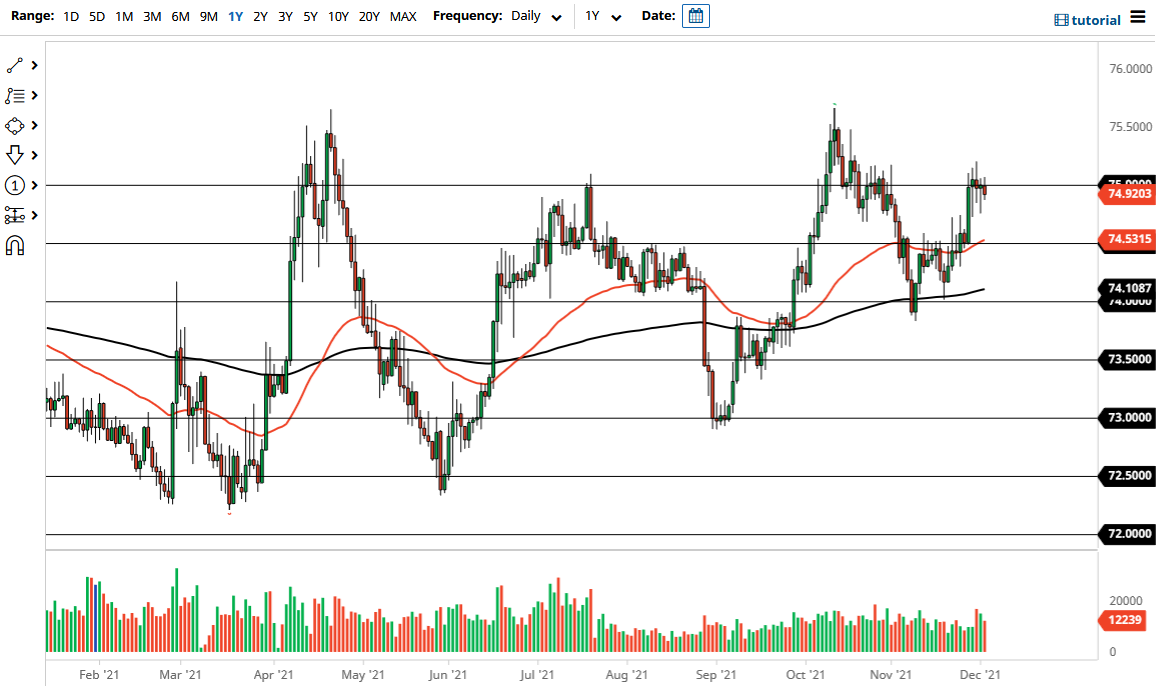

The US dollar has gone back and forth during the trading session on Thursday as we hang around the ₹75 level. The ₹75 level in the past has been resistance, and it certainly looks as if it is the same situation now. I believe the market testing this major resistance barriers a sign of just how weak India is at the moment, as traders around the world continue to run away from risk. After all, with a new variant of coronavirus, a lot of people are a bit concerned as market participants continue to be worried about lockdowns.

The US dollar is strong not only do to that, but the fact that the US economy is one of the stronger economies in the world. As long as the US economy continues to strengthen in general, that will more than likely work against India, unless of course the global supply chain start to open up again. Ultimately, the market is likely to continue to see a lot of momentum chasing, but we need to break above the ₹75.20 level to clear the short-term resistance. At that point, then it is likely that we go looking towards the ₹75.50 level.

If we do break down from here, I see a significant amount of support underneath at the ₹74.50 level, where the 50 day EMA currently resides. Furthermore, it is starting to tilt to the upside, so that suggests that we are going to have more momentum from intermediate traders as well. It is not until we break down below that level that I think we might have a bit of trouble showing up in the market again. The market will continue to see a lot of noisy behavior based upon risk appetite, as the Indian rupee is of course an emerging market currency. EM currencies have struggled lately, as I have been observing in the South African Rand, Hungarian forint, and many others that I prefer to trade. Ultimately, I believe that the market will eventually go looking towards the ₹75.50 level, but it may take a while to get there. After all, this is a market that tends to be more of a grind than anything else, but as long as the US leads the world, it is difficult to imagine this market breaking down for any significant amount of time.