The S&P 500 rallied just a bit on Wednesday, as we are hanging just below the 4800 level. Quite frankly, this is a market that you cannot sell, but it does not necessarily mean that you need to jump into it a day or two before the year ends. What I am hoping to see more than anything else would be a little bit of a pullback that I can use for a better entry, because I do believe that once we get back to work next week, money managers will be looking to put risk back on to open their books for the year. Typically, that is a very positive time of the year, and could possibly be exacerbated depending on what the jobs number is going to be on Friday.

Between now and then, I think this is essentially just killing time and I do not suggest trading at all. The market is a little overextended as it is, so to think that over the next couple of days, while there is no real enthusiasm, that we could have a little bit of a drift lower is not a huge surprise. That does not essentially mean anything at all, and I believe that by the time it is all said and done we will simply see this is yet another opportunity to buy the S&P 500 along the way.

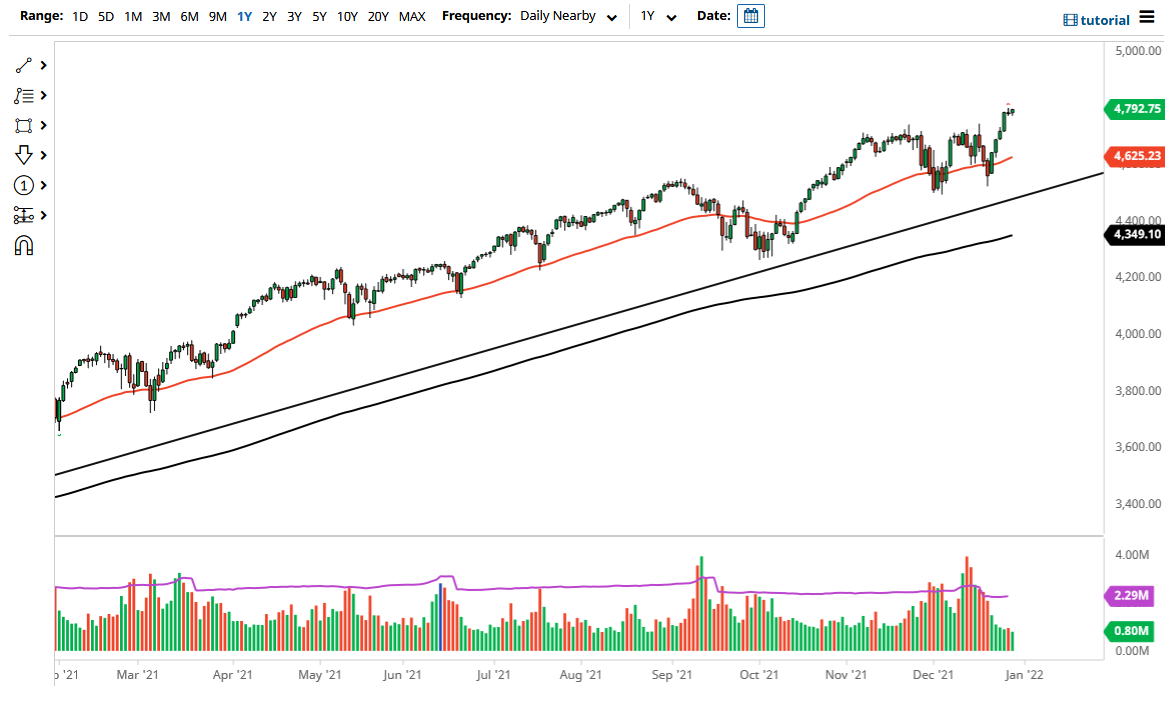

Sometime this spring, I expect to see the S&P 500 at 5000, maybe sooner than most of you realize. With the Federal Reserve looking to taper bond purchases, there are some people out there that are concerned, but they have proven themselves more than willing to reverse if it has a negative effect on the markets. There is nothing going on right now that is any different than any other time, and when it is all said and done, if Wall Street starts to feel the pain, the Federal Reserve will come bail them out. The 50 day EMA currently sits at the 4625 handle and is curling higher. In general, I see no reason whatsoever to short this market, but I do recognize that if we were to break down below 4500, it would change the overall complexity of everything in this index.