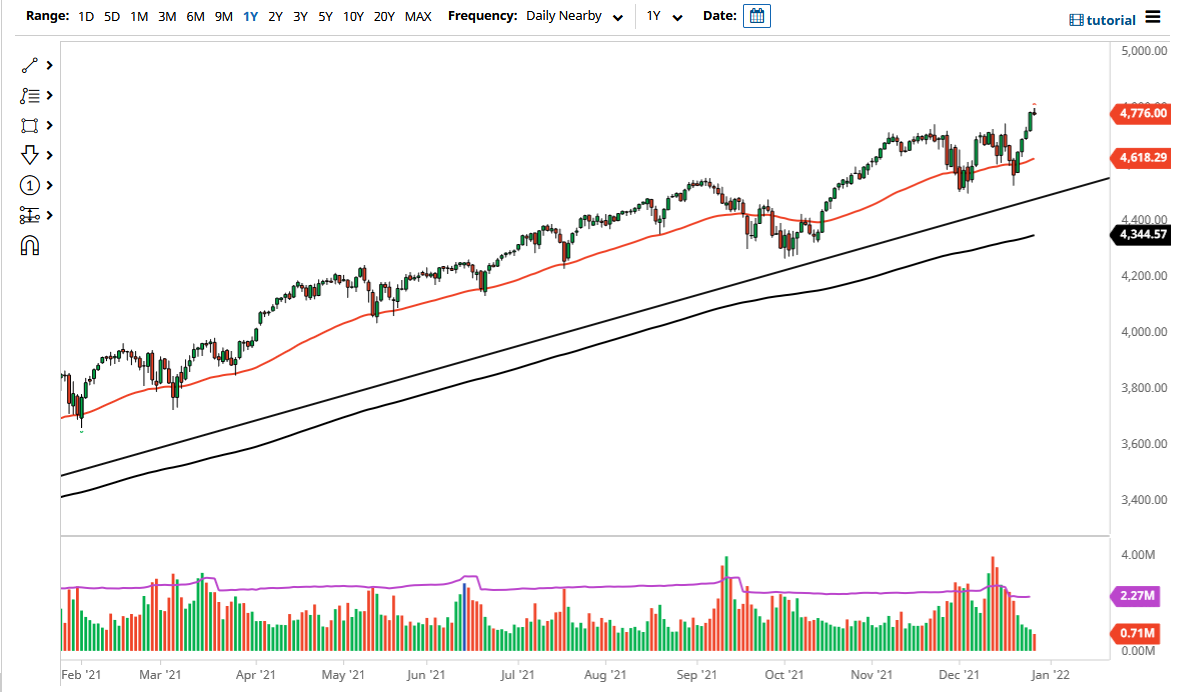

The S&P 500 rallied initially on Tuesday to reach all-time highs yet again. We did give up some of the gains though, and it looks like we are running out of momentum. It is not a huge surprise considering we had gone parabolic, and it looks like we are reaching the end of the “Santa Claus rally.” That being said, people will be looking to take profits and focus on New Year’s instead of gambling in the markets.

The 50 day EMA sits at 4618, and I think it will be heavily defended if we do pull back. Nonetheless, I do not even think we will fall that far. I think it is more or less going to be a situation where we drift lower over the next couple of days. I would not be a seller, and in fact I do not even know that I would do anything at this point. The will be here after the New Year, and that is what you need to keep in the back of your head. What I am hoping to see is some type of significant pullback that I could start buying into in January, as traders out there will be putting more risk on again. It will especially pick up once we get that January jobs report, which in general kicks off the trading year. Regardless, I am not selling this market and believe that the absolute “floor in the market” is closer to the 4500 level. Anything under there I might be a buyer of puts, but I do not see the scenario where that becomes a reality. The market is one that I do think goes much higher eventually, but if you are just patient enough you may be able to find a better price to get involved.

I believe sometime this spring we are going to see 5000, and as things stand right now that is my plan for January, finding some type of value and then hanging on until we get to the 5000 level. I will be adding along the way as well due to the fact that it is obvious we are still very much in an uptrend.