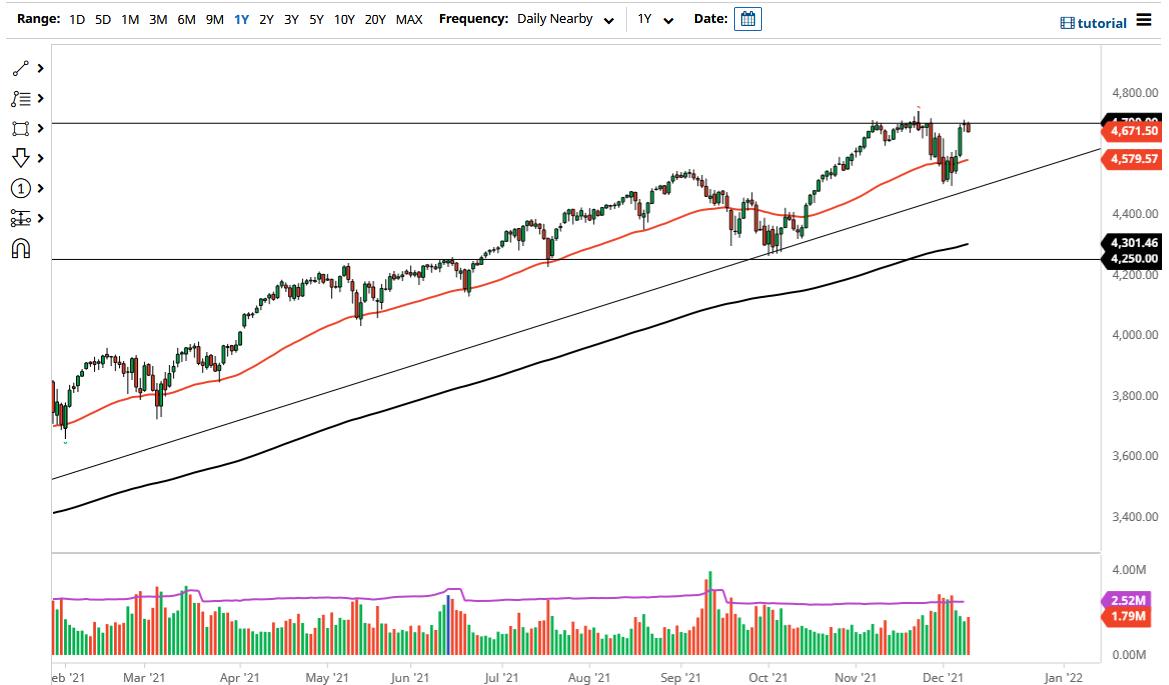

The S&P 500 has pulled back during the trading session on Thursday to show signs of weakness at the 4700 level yet again. This hesitation is something that we have seen more than once, therefore it suggests that it is going to take a significant amount of momentum to finally break out to the upside. The 50 day EMA underneath sits just below the 4600 level, which is an area that has been noisy here recently as well. That being said, I think the market is probably going to continue to see a lot of volatility as we head towards the end of the year, but I do believe that the “Santa Claus rally” is still going to be the big story.

On a pullback, I will be looking at this market for signs of strength and a bounce, therefore I will get long again. I have no interest in shorting this market, we are far too strong and although the last couple of days have been a bit difficult to deal with, we are only down about 0.2% or so from the all-time highs. This is hardly a market that is falling apart, so I think it is only a matter of time before we see value hunters taking control of this market yet again. I think at this point in time it is difficult to get overly aggressive one way or the other, but if we get a significant selling move, then I will be looking to “leg into the position.” I will add slowly and wait for opportunities on signs of recovery to get involved in a market that is obviously heading in one direction over the longer term.

I believe that the 4500 level is going to be a bit of a floor in the market, and therefore I think we continue to see plenty of money managers out there willing to pick up value due to the fact that they are chasing those returns. If we were to break down below the uptrend line, then we could go looking towards the 200 day EMA, but it is very unlikely that we will see that happen. If we do, then it could be due to a lack of liquidity as we head towards the holidays. That being said, this is a market that retains its overall shape.