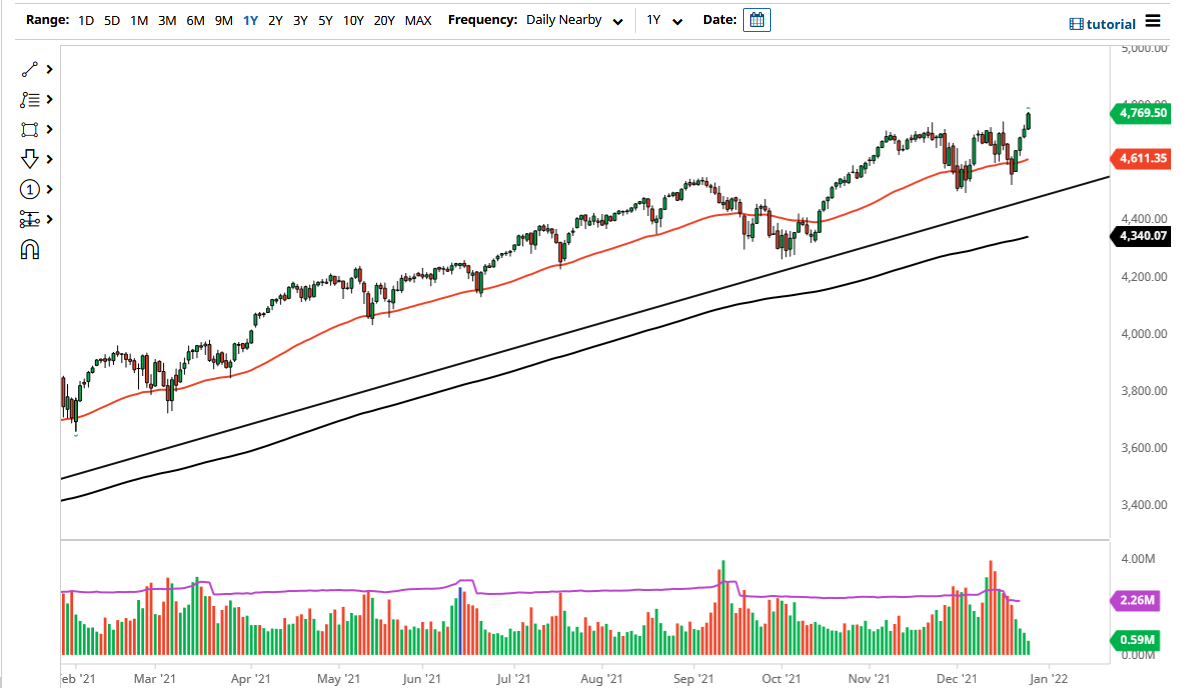

Monday saw bullish pressure in the S&P 500 again, as we broke to an all-time high. The stock markets in general do quite well on Monday considering that it is the week between Christmas and New Year’s, so it is very possible that we are now finally getting the “Santa Claus rally” that we typically get at the end of the year. Because of this, I like the idea of buying short-term pullbacks, treating them as value plays for short-term trades. The candlestick is closing at the very top of the range for the day, so that is something worth paying attention to because it typically means that there is going to be some type of follow-through.

The next psychological level will be 4800, but I do think that the intermediate-term target is probably going to be closer to the 5000 handle. I have no interest in shorting this market, because you cannot short US indices under any circumstance. The index is highly influenced by just a handful of stocks, and as it is not equally weighted, so you only need the Wall Street darlings to do well for the S&P 500 to rally. That being said, we are a little bit stretched that we might get a short-term pullback, but I think a pullback will only offer yet another opportunity to get long in what is a very strong uptrend.

The 50 day EMA sits at the 4611 level and is turning higher to suggest that it is going to be supportive if we do somehow get down towards it. Try not to overthink things; just recognize that it is the end of the year and people are trying to make returns by buying the most favored US stocks, which will drive both the S&P 500 and the NASDAQ 100 higher. The fact that we are closing towards the very top of the candlestick is a good sign, suggesting that we are probably going to have follow-through during the day on Tuesday as well, perhaps even throughout the rest of the week for that matter. I have no interest in shorting, as there is nothing on this chart that even remotely suggests that there is a weakness coming. If we did break down below the 4500 level it would be very destructive, but I just do not see that happening anytime soon.