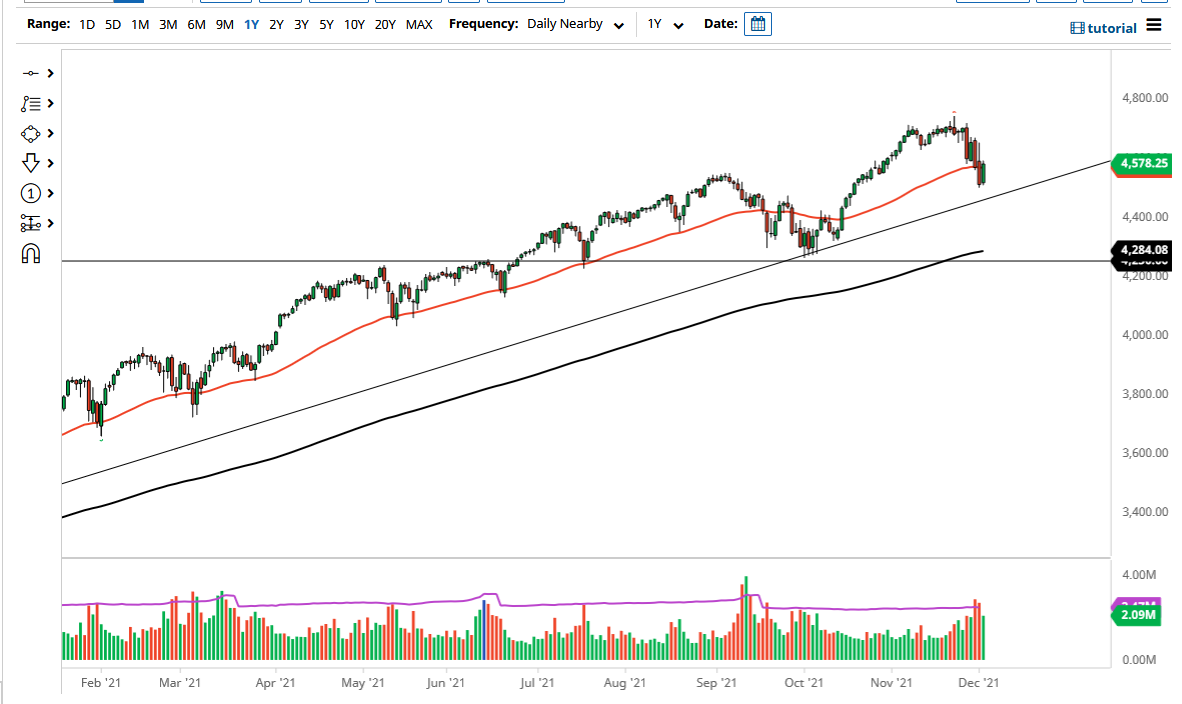

The S&P 500 has rallied significantly during the course of trading on Thursday to wipe out the losses from the Wednesday session. We managed to close above the 50 day EMA, as it looks like markets are ready to continue to go to the upside for a longer-term move. All things being equal, this is a market that I think continues to see plenty of interest, as we have seen so much in the way of bullish behavior over the last several months.

Yes, the market has negative for a while, but that has been the most recent behavior, and at this point in time it is but a blip on the radar of the longer-term trend. That being said, the market is likely to continue to see buyers looking for value, especially as the end of the year approaches, and people will be looking to reach some type of benchmark for their clients. Because of this, we have the so-called “Santa Claus rally” that typically happens at the end of every year, and I do not see this year being any different. Because of this, I think what we have is a scenario where every dip will be bought into, and we will eventually go looking towards the 4800 level.

The market is currently hanging around the 50 day EMA, so that will attract a lot of trading, but at the end of the day the most important thing to pay attention to here is the fact that the jobs number is coming out on Friday, and it will almost certainly cause a significant amount of volatility. The market selling off quite drastically on Friday will almost certainly be bought back into, which is typically the case with the Non-Farm Payroll Friday situation. This is because liquidity disappears, and people will find some type of narrative to start buying the dips. That is what Wall Street does, it finds reasons to go higher. Furthermore, even though the Federal Reserve is pretending like it is worried about inflation, the reality is that the first time Wall Street throws a serious tantrum, they will step in and save the banks. Because of this, it is not really a market so much as it is a bidding war to see who can push things higher over the longer term.