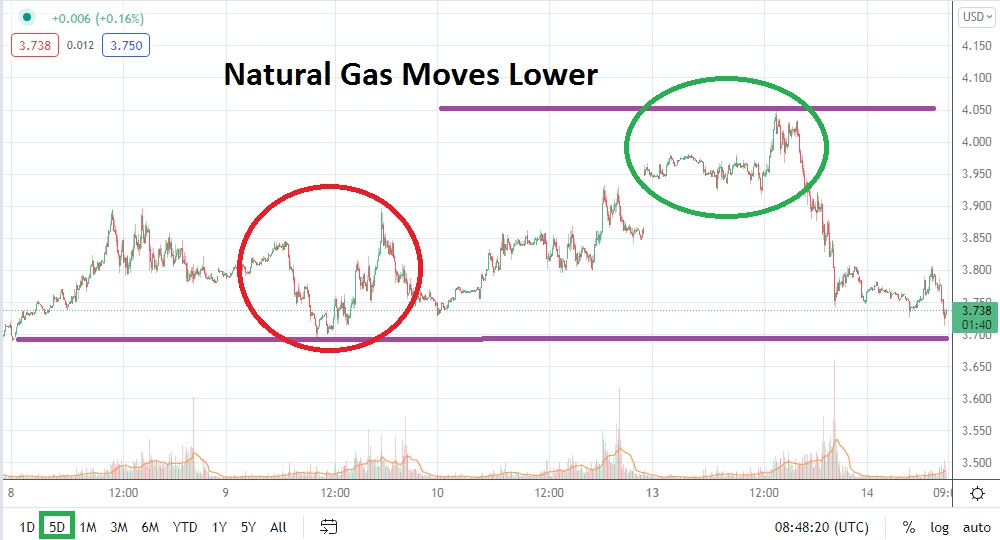

As of this morning, natural gas is trading near the 3.720 ratio as it has produced a downturn after actually breaking above 4.050 momentarily yesterday. After making this short-term high on Monday, which was the first time natural gas had traded above the 4.000 since the 3rd of December, the commodity resumed its downward momentum. Current values for natural gas are now making technical traders consider long-term charts.

On the 6th of October, natural gas was trading near a high of 6.500 USD, but since hitting this apex the commodity has seen an erosion in value as speculative buying has weakened, and perhaps the prospect of a milder winter have caused a price decline. Intriguingly, natural gas was at 3.730 on the 19th of August before surging higher. If this August support level falters in near-term trading, natural gas will actually then have lows last seen in the third week of July as inflection points.

The selloff demonstrated in natural gas is a classic case of commodity speculation based on technical and behavioral sentiment synergy. Supply concerns certainly affected the price of the commodity in the fall of this year, but price velocity upwards also created a surge in speculative buying which ran out of power in October. Choppy conditions have been demonstrated since then, but traders should note that on the 29th of November natural gas was still trading near 5.000 USD. Ladies and gentlemen, this price was seen only two weeks ago. Volatility within the commodity markets produce speculative dreams and nightmares. Caution is urged.

While natural gas now challenges important support, skeptical speculators may start to believe the commodity has now been oversold. Traders need to practice stop loss tactics to guard their accounts against massive fluctuations, but experienced commodity speculators may feel like now is the time to actually look for reversals higher to begin showing signs of life within natural gas.

If current support levels can be sustained, traders may feel that buying natural gas and looking for upside momentum to develop is reasonable. Technically, natural gas appears ready to rebound, but sustained trading above the 3.750 to 3.800 may be wise to look for before attempting to catch a trend higher.

Natural Gas Short-Term Outlook

Current Resistance: 3.850

Current Support: 3.650

High Target: 4.080

Low Target: 3.540