The NASDAQ 100 broke down again on Tuesday as traders await the results of the two-day meeting from the Federal Reserve. The question now is not so much as to what they are going to do, but rather how quickly they are going to do it. Most traders anticipate that there will be a certain amount of tapering coming, but the question now is whether or not the Federal Reserve is going to speed up the process. With this being the case, there is a bit of a “risk off” type of trade out there, which works against the value of the NASDAQ 100 in general. The NASDAQ 100 is only driven by a handful of stocks, so pay close attention to the usual suspects.

Nonetheless, I do not think that Jerome Powell will do anything to upset the apple cart, and the press conference and statement after the meeting on Wednesday will set Federal Reserve credibility going forward. The Federal Reserve is stuck with inflation, but at the same time the economy probably cannot handle a strengthening of rates of any significance. It will be interesting to see what they do; my suspicion is that they will do as little as possible, perhaps becoming “data dependent” yet again.

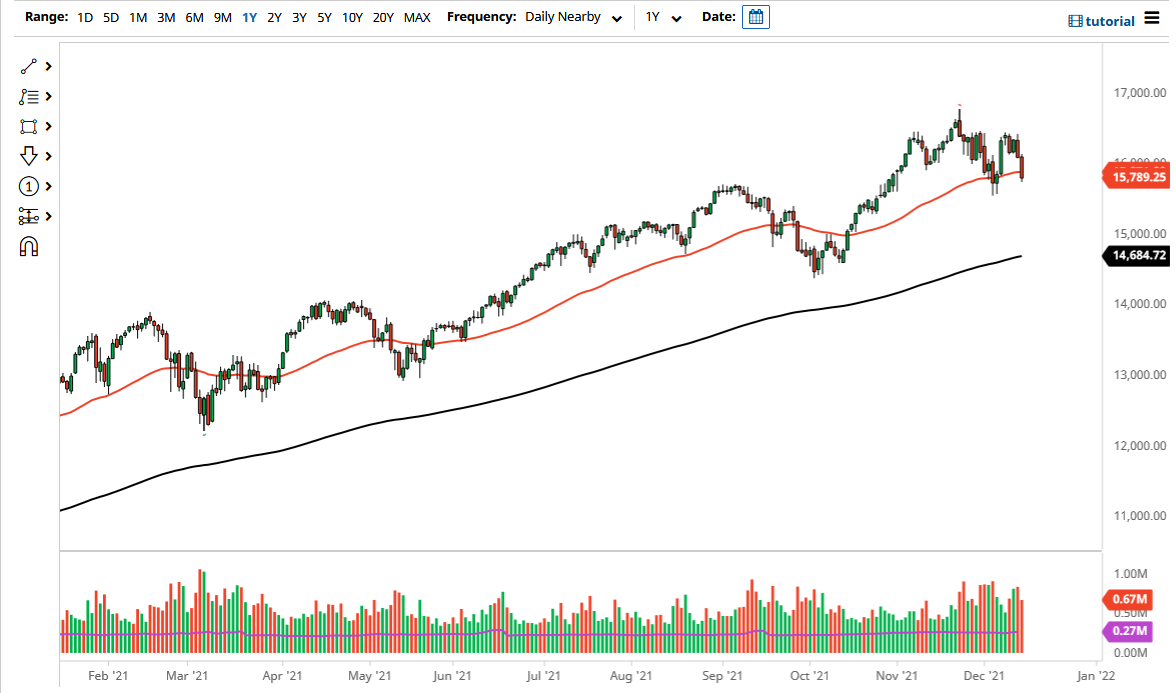

As far as I can tell, the only data that they are willing to pay attention to are whether or not stocks are rising or falling. This is a market that still very much in an uptrend even though we have struggled as of late, but I think there will be dip buyers given enough time. Having said that, we are sitting just below the 50 day EMA, so it will be interesting to see if the buyers can build up a little bit of momentum. At this point, I would not be overly aggressive in one direction or the other, so you are probably best served waiting to see how this shakes out after the meeting at the end of the day on Wednesday. After that, then traders start to focus on holidays, meaning that liquidity will start to dry up rather rapidly. Either way, you know I do not short the market, but if we broke down below the 15,500 level, I might be convinced to buy short-term puts.