The NASDAQ 100 took off to the upside on Monday, as it looks like we are ready to continue going much higher. This is a market that will continue to see buyers on dips, and more likely than not eventually break out to a fresh, new high. After all, traders will be chasing any returns they can get between now and the end of the year in order to report them to clients, and the NASDAQ 100 is one of the favorite tools to that end. You only need a handful of stocks to make this a move like Tesla, Microsoft, Amazon, etc.

Even if we do get some kind of reasonable pullback, I do not think it is going to be anything more than a temporary blip on the radar, and I have no interest whatsoever in trying to get short of this market. What am waiting to do is buy a little bit on a dip, and then as it works out my favor buy a little bit more and add to it as it continues to go higher. I still believe that we are more likely than not going to go heading towards the 17,000 level, and that could be much quicker than a lot of people think.

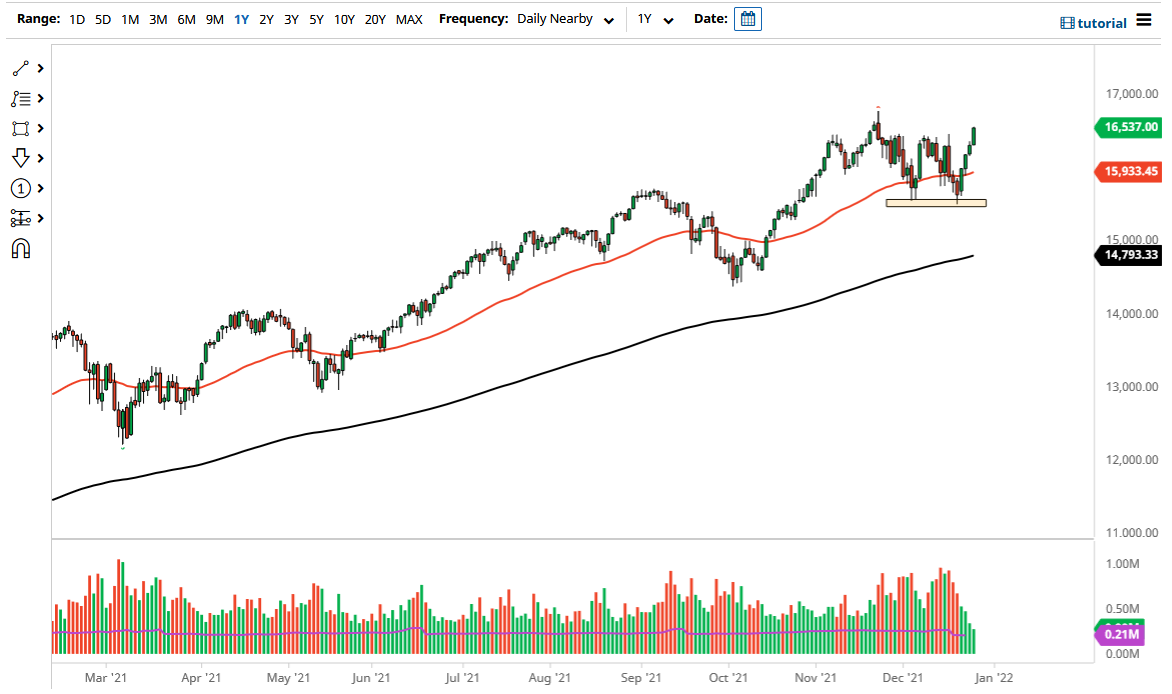

The 50 day EMA currently sits just below the 16,000 level and is rising a bit, so that is an indicator that I think a lot of people will pay a certain amount of attention to, but quite frankly at this point in the year I do not pay as much attention to technical analysis as I do momentum which is most certainly something that we definitely have in the NASDAQ 100 right now. Breaking above the 17,000 level would open up a longer-term “buy-and-hold” type of situation but I do not know if it will happen between now and the end of the year, or if it has to wait until traders come back to work for the month of January. After all, it's hard to put a bunch of risk back on to establish books for 2022. The NASDAQ 100 is one of the favorite indices to trade so there is no reason to think that it will be next year as well. You can see that I have the 15,500 level marked as a significant “double bottom”, and as long as we are above there I think we are in good shape.