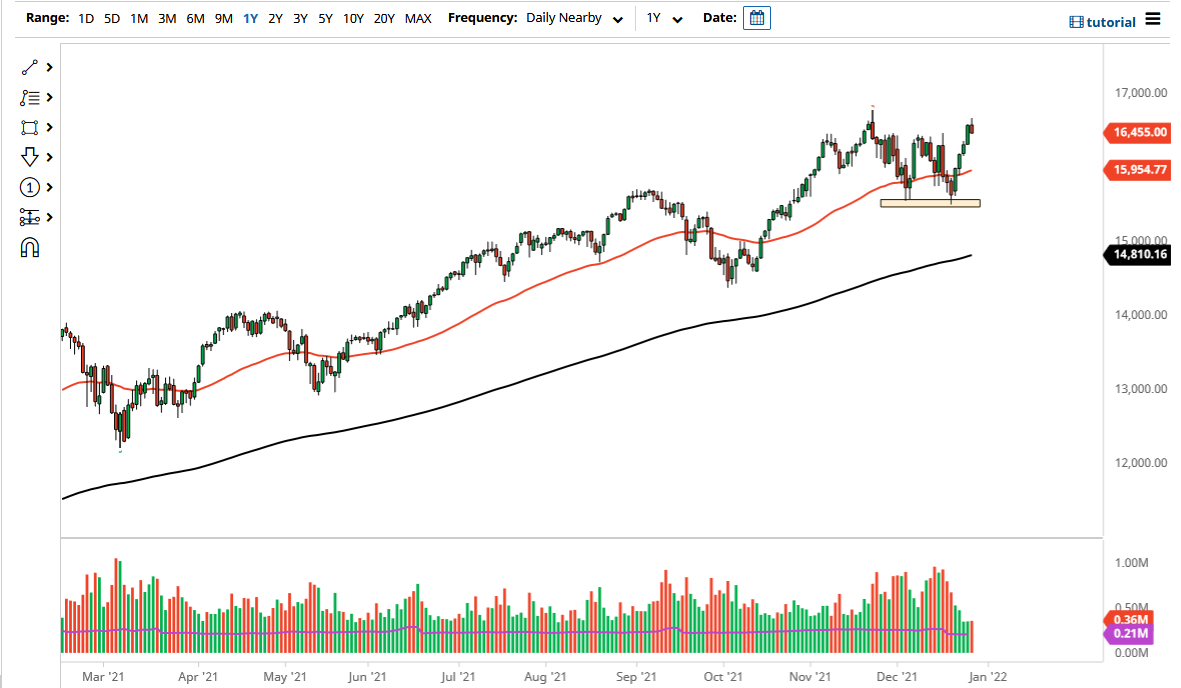

The NASDAQ 100 initially tried to rally on Tuesday but gave back gains to show that there is still hesitation to go higher. At this point, it looks as if the market does not have the momentum to finally break out to the upside, and I think we need to pull back a little bit in order to find a bit of value. Keep in mind that this is the end of the year, so the closer we get to the New Year’s holiday, the less likely we are to see bigger moves. I think short-term pullbacks will more than likely be what you can expect, but I think given enough time they should offer value that you can take advantage of.

The 50 day EMA sits just below the 16,000 level, so if we pull back towards that area, then I think it makes quite a bit of sense that we would find plenty of buyers to come and step up. Ultimately, we're in an uptrend, but it is difficult to get people overly excited this late in the year as most people are focusing on holidays and not trying to gamble for the last couple of days of the year.

The Santa Claus rally has already happened, so I think we will probably only have a bit of back-and-forth over the next couple of days and I would not be putting a bunch of money into the markets right now, because quite frankly nothing good can come of it. Once we get the jobs number at the end of next week, businesses will start to pick up as per usual, but the one thing that I do know about the NASDAQ 100 is you cannot short it. That is the thing with all US indices, due to the fact that they are not built to go lower. This is why they are not equally weighted, and therefore I am either looking to buy dips, or simply hang onto a trade that I have been into a while. At this point, it is not until we break down below the 15,500 level that I would be considering buying puts, but like I said, I never short these indices. Longer term, I think we go looking toward 17,000, but that might be a story for January.