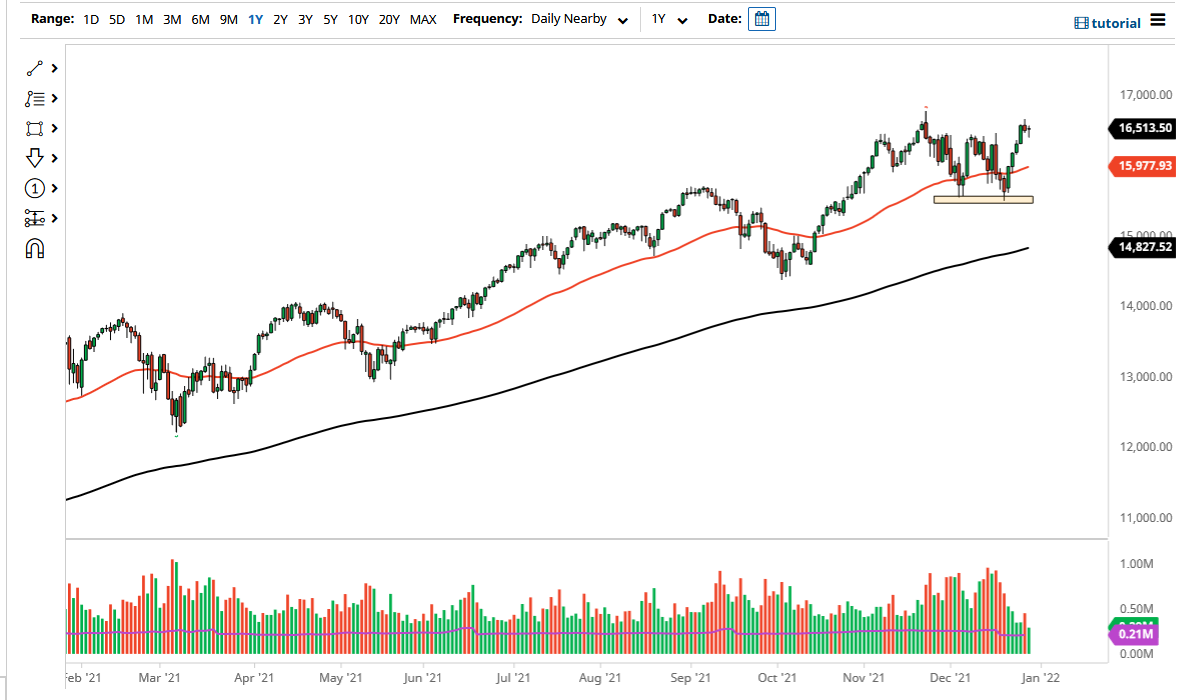

The NASDAQ 100 fell initially on Wednesday but gained back the losses to form a relatively unchanged candlestick. At this point, only the true gamblers are out there trying to trade it. The Santa Claus rally appears to be over so now I think the next couple of days are simply going to be people grinding away and killing time between now and next year. Keep in mind that a lot of books need to be flattened out at the end of the year so that managers can report profits to customers, and then almost immediately managers will have to put money back on in order to take risk for the following year.

The NASDAQ 100 is one of the first places people put money to work, as all of the highflyers drive it. The recent action has been rather strong, but now I believe the next couple of days will probably feature a lot of listless trading. What am hoping to see is a little bit of a pullback and then perhaps a buying opportunity early next week. I do believe that we will go higher given enough time, so I'm certainly not going to short this market, but a little bit of malaise would not be a huge surprise.

At this point, I think 17,000 might be the target, followed by much higher levels. Keep in mind that next Friday has the jobs number coming out, and that will be the first piece of economic data for the year. While there are some people out there concerned about the Federal Reserve tapering bond purchases, the reality is that monetary policy is still going to be extraordinarily loose. Furthermore, it is a well-known fact that if money gets to be a little too tight, the Fed will step right back in and lift everything up again. They have been doing this multiple times over the last 13 years and there is almost nothing that I can see that makes this time any different. Yes, inflation is a bit of an issue, but the question now is whether we are through peak inflation or not. Looking at this chart, there is a hard floor in this market closer to the 15,500 level, so as long as they above there I think the trend is very much intact.