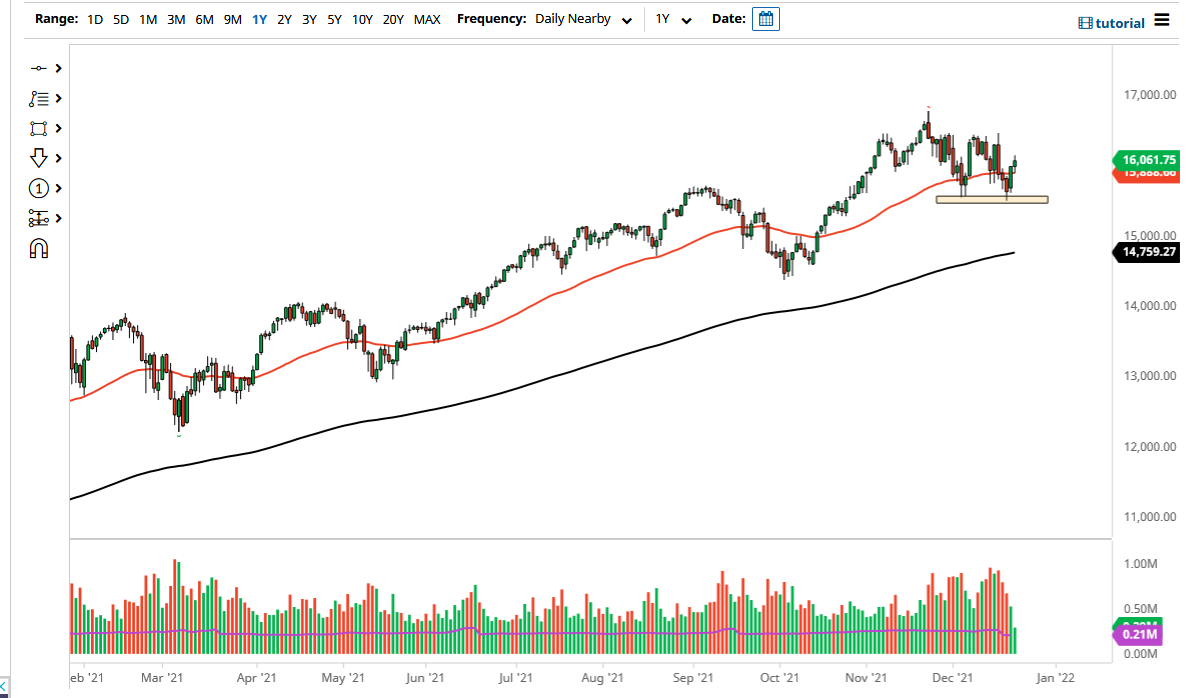

The NASDAQ 100 rallied a bit on Wednesday as we broke above the significant candle from Tuesday. We did give back some of the gains though, suggesting that this might be more of a grind to the upside. I find that perfectly reasonable, because it is the end of the year, liquidity is going to be an issue, especially over the next couple of days. While I would not be a seller of this market, I do not necessarily want to jump in with both feet and open up a huge position.

Underneath, the 15,500 level continues to be massive support, and the 16,400 level continues to be massive resistance. That is your range for the rest of the year from what I see, and I think you are probably going to have to use something like a stochastic oscillator to trade an overall range-bound market. I do not like shorting indices in the United States, so as a general rule I do not. However, if we were to break down below the 15,500 level, Imight be willing to buy puts, mitigating what my losses could be.

To the upside, if we were to take out the 16,400 level, then the NASDAQ 100 could go racing towards the highs again. For what it is worth, Tesla was up 8% during the day, which has an outsized influence on where this index goes. Quite frankly, it does not matter what 93 stocks do, it is just about seven or eight that really matter. That is one of them, and it was very strong. That being said, it is not like we broke out of major resistance, it just looks like we have a little bit more in the way of upward momentum than down. I would not try to build a big position now, but I would be convinced to buy dips on short-term charts with small positions.

Keep in mind that the closer we get to Christmas, the thinner liquidity will get and then we can have sudden spikes as people are closing out their books for the year. The last thing you want to do is get caught in one of those moves, because it can drain your account rather quickly. It is because of that that I normally trade about 1/3 my normal size.