Gold futures contracts joined the financial markets that are negatively affected, as gold fell to $1766 before settling around $1772 as of this writing. This decline was caused by the strength of the US dollar ahead of the US Federal Reserve’s policy meeting, which may determine the fate of gold prices, the economy and the stock market in 2022.

Gold has been in turmoil for nearly all of 2021, and is down nearly 7% year-to-date. Silver, the sister commodity of gold, is also falling. Silver futures fell to $21.895 an ounce. The white metal saw a horrific year, dropping nearly 18%. Metals are heading lower as financial markets prepare for the Federal Open Market Committee (FOMC) policy meeting that will conclude on Wednesday. A new CNBC poll found that economists expect the institution to start raising interest rates in June and halt asset purchases in March. The market is not stopping any price hike over the next few months.

Amid all the chaos in the stock arena, investors are looking for a haven in the dollar. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major rival currencies, rose to 96.47, and its stronger profit is bad for dollar-priced commodities as it makes them more expensive to buy for foreign investors.

The US Treasury market was higher for the most part, with the 10-year bond yield rising to 1.445%. One-year bond yields fell to 0.249%, while 30-year yields rose to 1.828%. The high yield environment is also bearish for metals because it raises the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures contracted to $4.2595 a pound. Platinum futures fell to $910.30 an ounce. Palladium fell to $1,624.50 an ounce.

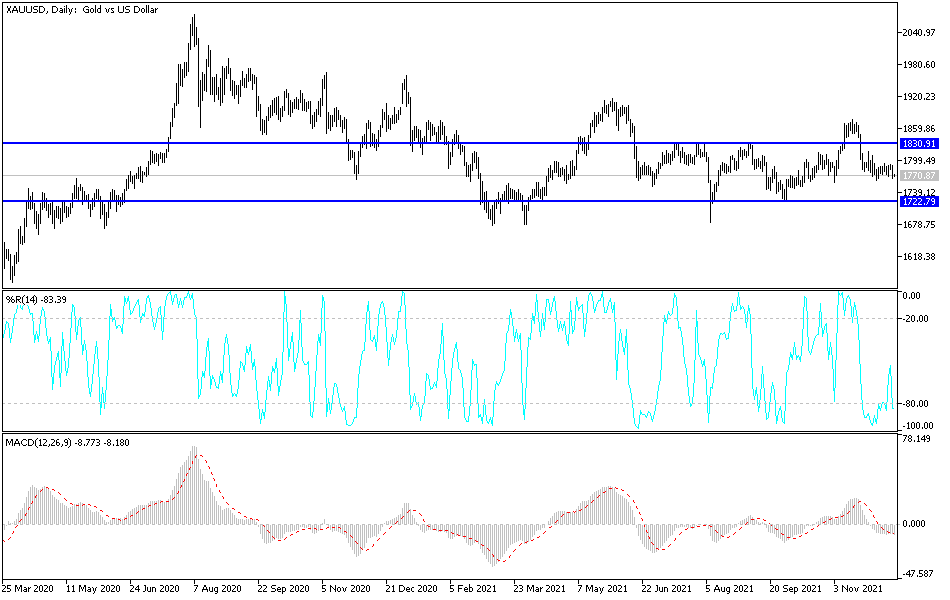

Technical Analysis

We had forecast that a move below the support level of $1775 will bring the bears the momentum for more downward movement, which is what is happening currently. New buying levels are currently $1757, $1740 and $1725. On the upside, the psychological resistance of $1800 will remain the key to a bullish rebound again.

It is necessary to take into account that today's volatility will be strong, and it is better to wait for the reaction from today's data and events to determine the most appropriate levels to enter buying or selling.