Although global central banks announced as one to tighten monetary policy, including those who actually raised interest rates, at the same time, appetite for buying safe havens increased amid Omicron fears. The price of gold returned to rise towards the $1815 resistance level before closing trading around $1798, with the recovery of the US dollar. Gold prices recorded a weekly rise of 1.3%, reducing its decline since the beginning of the year to date to less than 5%.

As for the price of silver, the sister commodity to gold, it is trying to regain the high of $23. Silver futures rose to $22.555 an ounce. The white metal is also poised to post a weekly increase of about 1.5%.

The price of gold was in decline when the US central bank planned to halt its purchases of pandemic-era assets in March and begin raising interest rates soon after. Moreover, the European Central Bank (ECB) said it will close the page on its Pandemic Emergency Purchase Program in March. The Bank of England (BoE) shocked the markets with a 15bp rate hike.

Commenting on what happened, Pierre Verrett, technical analyst at ActivTrades, wrote in a daily note: “It is no surprise to see gold heading higher as global uncertainty created by central banks and rising US-China tensions continue to undermine investors' appetite for riskier assets. “In addition, the recent decline in the US dollar in the wake of the monetary decisions of the Federal Reserve provided more support for safe havens and commodity markets in general.”

The precious metal halted its gains on the back of the dollar's strength. The US Dollar Index (DXY), which measures the dollar's performance against a basket of other major currencies, rose to 96.17, and as it is known, the US Dollar Index DXY is on its way to achieving a tepid jump of 0.1% last week. Since the beginning of the year 2021 to date, the index has increased by 7%. Another factor affecting the gold market is the US Treasury market mostly heading into the red, with the 10-year yield falling to 1.38%. The value of the one-year bonds fell to 0.241%, while the yield on the 30-year bonds fell to 1.812%.

As for the prices of other metals, copper futures were unchanged at $4.308 a pound. Platinum futures rose to $932.40 an ounce. Palladium futures rose to $1,792.00 an ounce.

Britain's health minister has refused to rule out stricter restrictions on the coronavirus before Christmas amid the rapid rise in infections and continuing uncertainty over the Omicron type. "There are no guarantees in this pandemic, I don't think," Javid replied when asked about the possibility of new restrictions. "At this point, we just have to keep everything under review."

British Prime Minister Boris Johnson this week restored rules requiring face masks in stores and ordering people to show evidence of vaccination or test negative for coronavirus before entering nightclubs and other crowded places. But government scientific advisors have recommended more far-reaching restrictions to prevent hospitals from overburdening, according to leaked minutes from a meeting of the Scientific Advisory Group for Emergencies.

Overall, countries across Europe are moving to re-impose stricter measures to stem a new wave of COVID-19 infections spurred by the highly transmissible omicron variant.

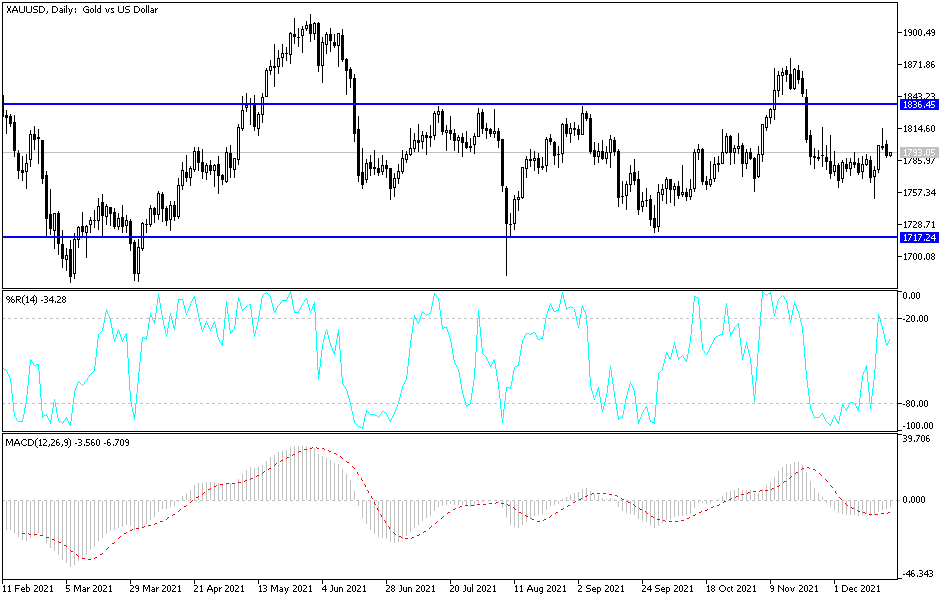

Technical Analysis

I still see that the stability of the gold price above the psychological resistance of $1800 will bring the bulls enough momentum for more upward movement, like to the levels at $1818, $1827 and $1845. These woudl be enough to turn the general trend bullish. On the other hand, the $1775 support level will remain crucial for the bears to keep the trend bearish. All in all, I still prefer buying gold from every bearish level.

The price of gold will be affected today, in the absence of important economic releases, by the strength of the US dollar and risk appetite.