The recent decline in the price of the US dollar helped the gold market to rebound upwards, reaching the $1820 resistance before the settling around $1805 as of this writing. Gold futures are looking to build and maintain some momentum as 2022 approaches. Gold rose strongly above $1800 in the last trading week of 2021. But what is driving the modest rise in gold and silver prices? Everything may be due to the strength of the US dollar and Treasury yields.

Gold is looking to recoup some of its losses in 2021, down about 4% year-to-date. As for the price of silver, the sister commodity of gold, it is trying to climb above $24. The white metal has had an awful year, dropping nearly 12%.

In recent weeks, investors have been taking on US government debt, which has dragged down Treasury yields, which may not bode well in an inflationary environment. The US Treasury market was mostly in the red on Tuesday, with the 10-year bond yield dropping to 1.462%. One-year bond yields rose to 0.302%, while 30-year yields fell to 1.864%.

A low-priced market is usually good for precious metals because it reduces the opportunity cost of holding non-yielding bullion.

As the US dollar struggles for direction ,the US Dollar Index (DXY), which measures the performance of the US currency against a basket of major rival currencies, fell to 96.00. The US Dollar Index (DXY) had a great year advancing close to 7%. A weak profit is also beneficial for the metals market because it makes it cheaper to buy dollar-denominated commodities for foreign investors.

However, market analysts warn that the outlook for gold is bleak due to the possibility of price normalization by the Federal Reserve. The US central bank expects three interest rate hikes next year as it accelerates its rollback of pandemic-era stimulus and relief measures. As for other metals markets, copper futures fell to $4.4665 a pound. Platinum futures rose to $986.80 an ounce. Palladium futures rose to $1,933 an ounce.

Technical Analysis

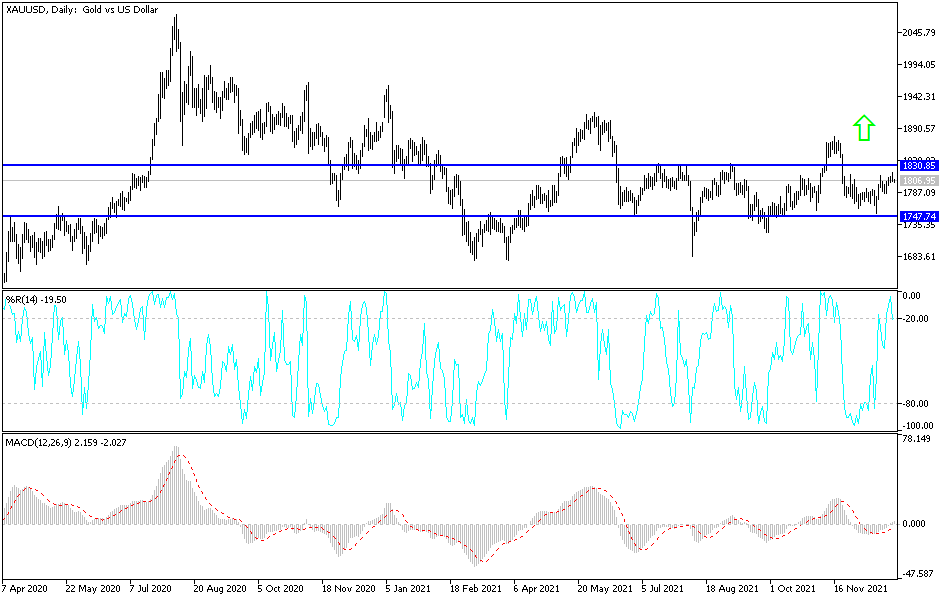

Gold prices recently reached their highest level in a month after the number of Covid cases around the world reached a record level. However, despite rising inflation and geopolitical factors that supported the demand for the yellow metal, the Santa Claus rally and the strong dollar hindered further progress. Over the past three weeks, gold bulls have been able to temporarily regain control of the general and prominent trend in an attempt to push prices back towards the 38.2% Fibonacci retracement at $1,835. And although the downward path from the August 2020 high is currently still in place, the price has risen above the 50-week moving average, which is currently providing support at the key psychological level of $1800.

On the daily time frame, price action has paused at the 50% retracement level that still offers resistance to the impending move at $1,818. As the bulls and bears battle it out, the CCI (Commodity Channel Index) has broken out of the normal range, a possible indication that the XAU/USD gold price may be in overbought territory.