Bearish momentum continues to dominate the GBP/USD amid a general risk aversion in global markets as investors balance the strength of the new COVID variant and its impact on the future of the global economic recovery. The GBP/USD recently collapsed to its lowest support level of the year, 1.3194, and is settling around the 1.3290 level as of this writing. Despite global concerns, all Covid-19 cases, hospitalizations and deaths in the UK are declining, but the population is still in fear. The significant local and global focus on the Omicron variant is a concern with real-time data showing consumers are falling behind in public places such as gyms, bars and restaurants.

Given that the services sector represents the bulk of Britain's economy, this indicates a slowdown at the end of the year.

“Real-time indications are that the consumer services sector has indeed declined since news of the Omicron variable emerged last week,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. He added that restaurant numbers last weekend weren't much higher than they were two years ago as they were the previous weekend, according to OpenTable. The numbers were 4% lower on Monday this week than two years earlier. Meanwhile, Google Trends data shows online searches that include the words "pub," "gym" and "restaurant," all of which have declined since November 26.

Data from Apple shows that the number of people in the UK requesting driving directions was 2% below its level in January 2020 between November 27 and 29, while unchanged from its level in January 2020 over the previous weekend. Consumer and business warning about the pandemic could prove to be an important pillar of economic activity, as demonstrated by the experience of July and August when growth stalled despite all official restrictions being lifted.

The government lifted all restrictions in England in July, but activity has been hampered by rising case rates and people have been asked to isolate. British Prime Minister Boris Johnson said on Saturday that new measures to curb the spread of Covid would come into effect from Tuesday, while UK-wide changes to international travel advisories were announced last Thursday.

The restrictions so far are limited to wearing masks and travel, but the prime minister has not ruled out taking further measures.

Technical Analysis

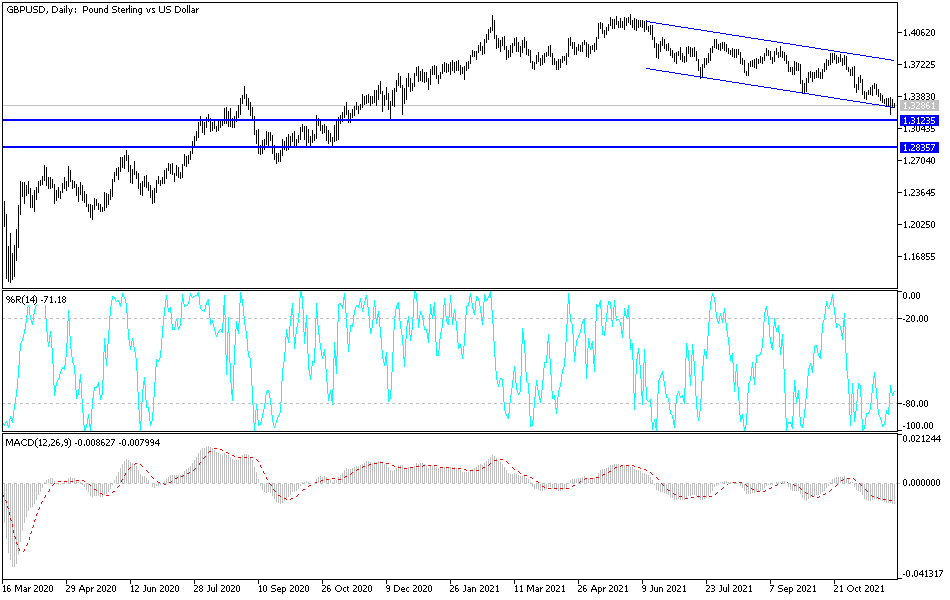

There is no change in my technical view of the GBP/USD currency pair on the daily chart, which is moving within a bearish channel. It is currently testing the lower line of the channel, which may move the technical indicators towards oversold levels, but the continuation of the pressure factors will allow the bears to move further downward. The closest support levels for the pair are currently 1.3245, 1.3180 and 1.3000. On the upside, the bulls will need to move towards the 1.3660 resistance to make a breakout of the current bearish channel.

Today's economic calendar is devoid of important British releases, and from the United States, the weekly jobless claims will be announced.