The Bank of England surprised global financial markets and investors by raising interest rates, and the pound gained strong momentum against the other major currencies. The GBP/USD rebounded to the 1.3375 resistance level, but with investors quickly returning to buying safe havens the pair gave up its gains and closed around the 1.3230 level, as global restrictions to contain the new COVID variant negatively affected investors' appetite for risk. So far, sterling appears to be supported, but the big risk for those waiting for higher rates is that the BoE will break another rally in February. The risk for sterling is that the BoE may slump after the December rate hike, a real possibility given the uncertainty surrounding the Omicron variable's trajectory and early signs that the economy is slowing rapidly.

Eight members of the Bank of England's Monetary Policy Committee (MPC) expressed concern that a failure to raise rates could cause inflation expectations to rise and voted to raise rates, but Professor Silvana Tineiro said due to the emergence of the Omicron variant he would prefer to wait until February. Accordingly, Daniel Vernazza, chief international economist at UniCredit, says, “The Bank of England is likely to skip a rate hike in February, choosing to assess any damage from Omicron.”

Overall, a sharp rise in Covid-19 cases coupled with significant pressure in real disposable income (from higher inflation and lower fiscal support), lower consumer confidence and slightly tighter monetary policy are likely to make the next few months difficult. Accordingly, analysts believe that these headwinds will likely force the MPC to hold off on raising interest rates for some time now, although it will likely be able to raise rates again before the end of next year.

And if true, the market will have to erase the high expectations of another rate hike in February. Given the recent strong shifts in the European Central Bank and Federal Reserve, this could leave the GBP vulnerable. For sterling to extend its February highs, expectations should hold up to say the least. In this regard, Ames Smith says that the bank should make two or three increases at most in the next year.

The bank also said that Omicron is not likely to decisively change the medium-term picture, but in the short term, it still means disruption to the British economy. ING expects policymakers to wait until later until 2022 before walking in again, a call that if true means interest rates and the exchange rate will undo some of their recent progress in the early part of 2022.

However, there are two variables that we will be watching:

The market expects the UK economy to face Omicron-inspired headwinds, but what about the US and Eurozone? It appears that the UK's Omicron wave will break sooner than the inevitable waves that will hit the US and Eurozone. And if they also endure a spike in cases in the coming weeks, some of the sting from the BoE's decision to skip a rate hike in February will be taken off.

At the moment, the pound is supported, but this support appears to be contingent on how fast Omicron declines.

Technical Anaylsis

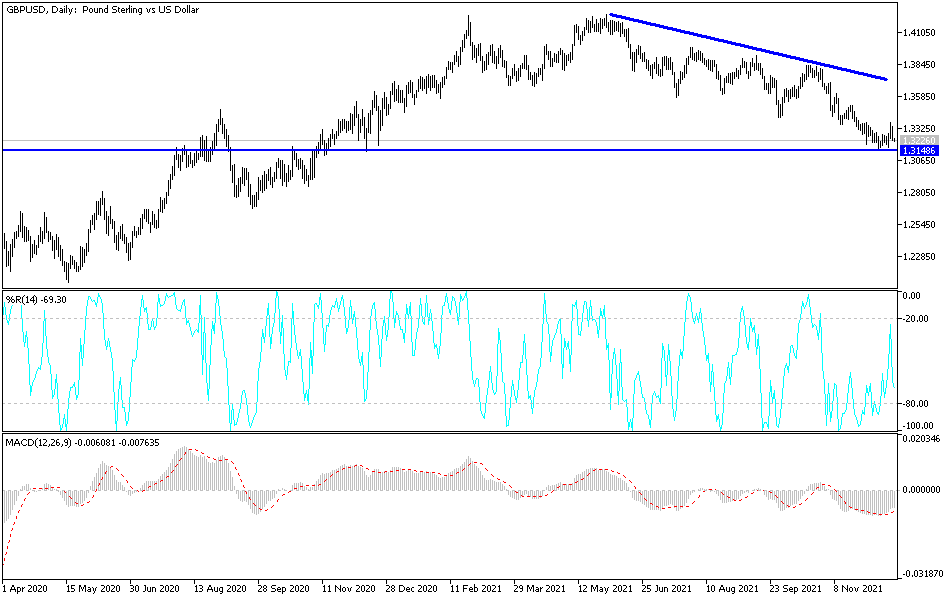

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD currency pair is trading within the formation of a sharp descending channel. This shows a significant short-term bearish bias in market sentiment. Therefore, the bears will look to move to 1.3205 or lower to 1.3184. On the other hand, the bulls will target short-term profits at around 1.3257 or higher at 1.3281.

In the long term, and according to the performance on the daily chart, it appears that the GBP/USD is trading within an ascending channel formation. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls are looking to move to the 1.3338 resistance or above to the 1.3439 resistance. On the other hand, the bears will target long-term profits at around 1.3135 or lower at 1.3043.