At the end of last week’s trading, the GBP/USD recovered from the losses that prompted it to test the main support levels on the charts. However, the rebound will face three challenges during the coming days, which may witness a retest of the lowest levels from last week. The GBP/USD currency pair has settled around the 1.3215 level, near its lowest for the year.

The British pound has entered the new week with additional downside risks this week from the dollar and its response to a possible Fed policy decision. "Get the booster now to protect the NHS, our freedoms and our way of life," British Prime Minister Boris Johnson said after announcing on Sunday an accelerated bid to make the third vaccine available to all adults by the end of the year.

The new Omicron strain of coronavirus has been cited to speed up the rollout of so-called booster vaccines, one that British government dashboard numbers indicate is already almost as strong as the first very successful campaign during early 2021. Despite this, it appears that the government's supposedly irreversible roadmap to reopening the economy has been increasingly pushed back with comments on Sunday following last week's move to "Plan B" and subsequent suggestions that even a so-called "Plan C" may be announced soon.

All of this leaves the UK economy and currency on the edge of a quite slippery slope as the dollar benefits from Wednesday's potential shift in policy at the Federal Reserve, which is widely expected to decelerate the quantitative easing program in the coming months. Juan Manuel Herrera, analyst at Scotiabank warns: “Overall, we see near-term weakness in GBP/USD towards the 1.30 support (on the back of hawkish Fed and BoE this week, as well as political risk) but with gains resuming in the new year before the Bank of England raising cycle.”

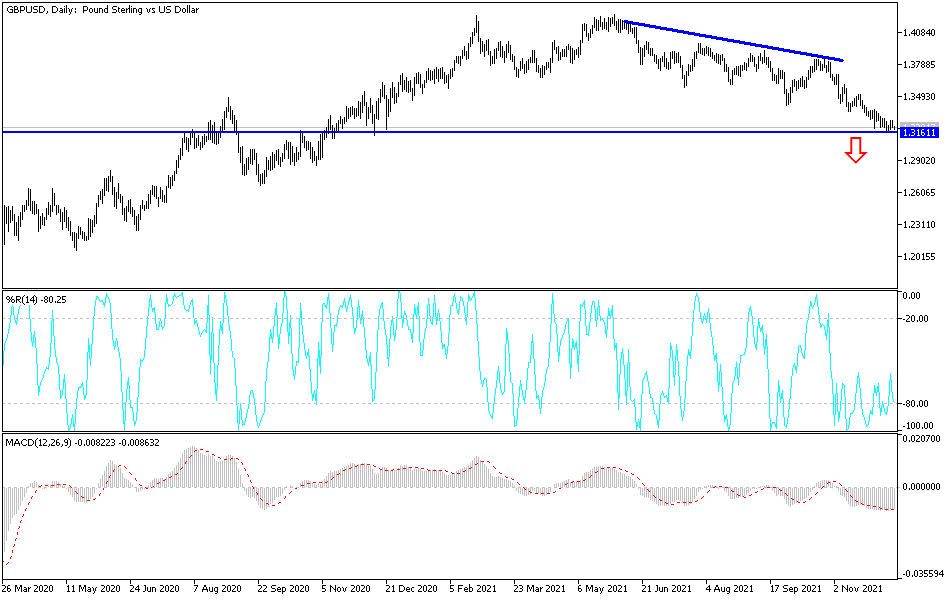

According to the analyst, the pair faces support at 1.3160/70 and the 200-week moving average at 1.3152 (widely averaged number area). The 1.33 area is firm resistance where the 100 week moving average also stands at 1.3294.

The Fed's accelerated reduction of its bond-buying program will likely create room for a rate hike sooner than the market previously thought, and Wednesday's updated economic forecasts will provide loose evidence of how quickly the bank's rate-setters expect it to be. At least 10 FOMC voting members - a decisive majority - have indicated in recent weeks that they might support a decision to end the $120 billion per month quantitative easing program sooner than the envisioned date of June 2022.

The Bank of England has said repeatedly in recent months that it will need to start withdrawing the interest rate cuts announced at the start of the pandemic if inflation is to return to the 2% target in an acceptable time frame, although the Bank wanted to confirm that unemployment has not gone up.

The last point is likely to be confirmed when labor market data for October is released on Tuesday, while Wednesday's inflation figure could reveal a continued acceleration of price pressures that would justify BoE thinking about a rate hike, despite the Bank's suspension on Thursday for the future forecast. The bank rate is likely to be more important to the British pound over the coming weeks and months.

The Bank of England triggered a problem in November with the market at the time expecting the bank rate to rise to 1.25% next year and by Friday the projected rate for December 2022 had fallen to 0.89% although sterling could be particularly sensitive about whether this message is repetitive. On Thursday, it will indicate if expectations will fall further in the coming weeks and months.

Technical Analysis

British restrictions to contain the new COVID variant brought the GBP/USD a new bearish momentum. The pair is now close to breaking down below a new strong support at 1.3200, which may pave the way for a move towards the psychological support at 1.3000 in the event that the current pressure factors continue. On the daily chart, the GBP/USD is still moving within its descending channel, and a breakout of that channel will not happen without moving towards the resistance level 1.3515. The GBP/USD currency pair will be affected by the announcement of the average wage, the change in British employment and the unemployment rate in the country. From the United States, the producer price index will be announced, one of the tools for measuring US inflation.