The GBP/USD was more stable at the end of last week but remained weak after the Bank of England (BoE) decided to continue interest rate outlook. On Friday's session, the GBP/USD pair rose to the level of 1.3275 and settled at the beginning of this week's trading around the 1.3250 level. Previous dips saw the GBP/USD rate briefly explore below the 38.2 Fibonacci retracement level to recover from the March 2020 lows, located around 1.3171, and bring it almost in touch with the 200-week moving average at 1.3150.

This was after the British government recently announced that some new and old restrictions on activity will be reimposed in the UK in a belated response to the arrival of the latest strain of coronavirus. “Local political stress due to poor governance and cabinet behavior led by Johnson and Downing St staff has precipitated the decision to adopt stricter Covid restrictions,” says Tim Riddell, a London-based expert at Westpac.

For the interest rate markets, the new restrictions decisively undermined any remaining idea among investors that a rate hike could be announced after next Thursday's BoE meeting, and also had the effect of dampening expectations for the BoE's decision in February 2022. So says Andrew Goodwin, chief economist In Britain in Oxford Economics: "A rate hike in December will require the MPC to be satisfied that the end of the holiday scheme has been benign and that the Omicron variable will not derail the recovery."

"It is possible that the majority have seen enough to make sure the labor market recovers, but they want more evidence on Omicron," Goodwin added.

While some economists and analysts maintain more optimistic forecasts, Thursday's bank interest rate of just 0.115% on Dec. 16 implied that investors see barely a 10% probability of raising the benchmark to 0.25% this week, down from a 33% implied probability prior to that. Some analysts say that by the December 16th meeting, we think there will be enough information for the BoE to at least feel comfortable with a 15bp increase. Expectations for the Bank of England's February meeting were also trimmed in the same rate action, with the implied rate dropping from 0.31% to 0.25% and leaving it in line with the level that would prevail after a record increase of 15 basis points to 0.25%. .

Expectations for a policy change in December have steadily declined since last Friday when Michael Saunders, the Bank of England's hawkest rate maker, suggested that the arrival of the Omicron coronavirus strain in the UK might be worth the delay in any decision to start a rate hike. Deputy Governor for Monetary Policy Ben Broadbent also said he is not sure how the new pressures will affect his bank interest rate decision this week, discouraging the market from expecting a rate hike.

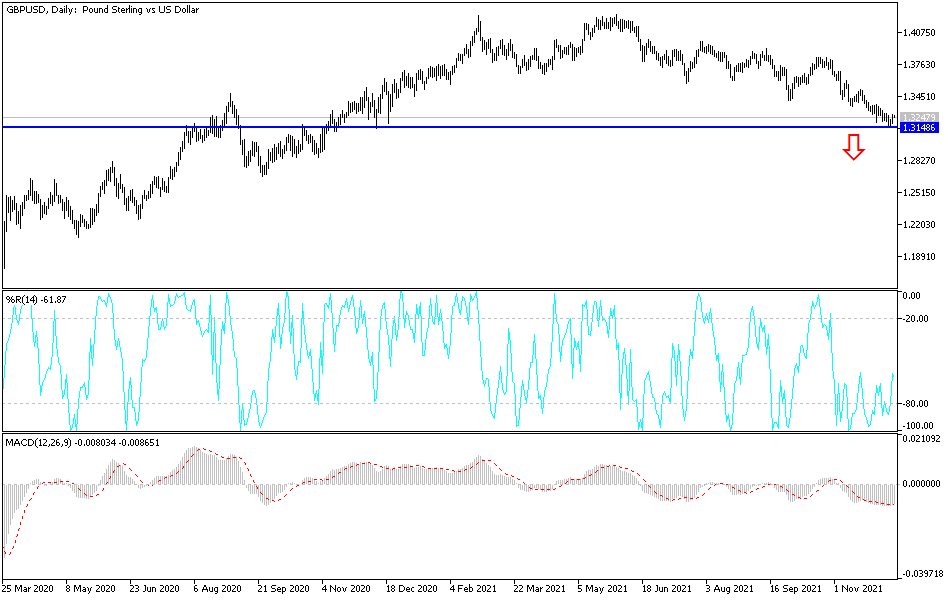

Technical Analysis

In the near term, and according to the hourly chart, it appears that the GBP/USD currency pair has rebounded recently from a major support level at 1.3190. However, the pair has not yet returned to forming an ascending channel. Therefore, the bulls will aim for extended rebound profits at around 1.3227 or higher at 1.3251. On the other hand, the bears will look to pounce on 1.3184 or lower at 1.3160.

In the long term, and according to the daily chart, it appears that the GBP/USD currency pair is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in the market sentiment. Therefore, the bears will look to ride the current downtrend towards 1.3129 or lower to the support 1.3043. On the other hand, the bulls will target long-term profits at around the 1.3286 resistance or higher at the 1.3368 resistance.