The GBP/USD has been moving in narrow ranges with a stable bearish bias around the 1.3240 level, and yesterday touched the 1.3190 support level after the improvement in British jobs and wages numbers. Today, UK inflation figures will be released through the CPI and PPI readings. Then there will be an important announcement for the Forex market in general, which is the US Federal Reserve's announcement of an update on its monetary policy.

Yesterday. UK labor market statistics for October-November showed a stronger-than-expected rise in UK wages, suggesting that inflationary pressures in Britain may remain elevated for longer than the Bank of England forecast. The additional confirmation that ending the government's job support scheme did not result in a rise in unemployment will give further assurance that the British economy can support higher interest rates in 2022.

However, the data come amid fears of another spike in Covid cases, which means the bank's monetary policy committee meeting on December 16 could leave rates unchanged at record lows. Commenting on this, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, says: “The labor market report is likely to be strong enough to convince the MPC to raise the bank rate at this week's meeting, if Omicron does not appear.”

Despite Omicron, the outlook remains constructive for the economy and sterling given that the Office for National Statistics said average income (+ bonuses) rose 4.9% in October; This was down from 5.8% in September but higher than the 4.6% market expected. However, employment increases appear to be slowing with headline employment rising 149K in the three months to October, down from the 247K growth recorded in the three months to September. The market was looking for a gain of 228K.

Slowing employment gains and rising wages may indicate fierce competition for a limited pool of labour, which is wage inflationary and provides a demand-side inflation driver that the BoE cannot ignore indefinitely. Indeed, it appears that the labor market will remain strong with the number of job vacancies rising in September to November 2021 to a new record of 1,219,000, an increase of 5,0434 from the pre-coronavirus level from January to March 2020.

This was the reason why economists argue that if the Bank of England avoids a December 16 rate hike, they will almost certainly have to raise rates in February, an expectation that supports sterling valuations. “Labour market conditions are tight, as evidenced by low unemployment, strong wage growth, and a large number of job vacancies,” says Fabrice Montagni, an economist at Barclays Bank.

He adds, however, that the exact degree of labor market tightness “remains subject to interpretation because the various issues of bias and scaling still blur the picture to some extent." Bank policymakers have said through most of 2021 that they will avoid raising interest rates in order to assess the impact on the labor market of ending the Covid government jobs support scheme known as furlough. There were concerns that ending the scheme would increase unemployment. But those seeking out-of-work benefits fell 49.8 thousand in November, a faster improvement from -14.9 thousand reported in October.

Overall, the UK labor market appears to be in a strong position as December approaches and the bad news that Omicron's variant of Covid-19 could lead to another wave of infections. The British government is imposing new measures to contain the variable, but these measures will inevitably hit economic activity and will constitute headwinds to the recovery in employment.

Technical Analysis

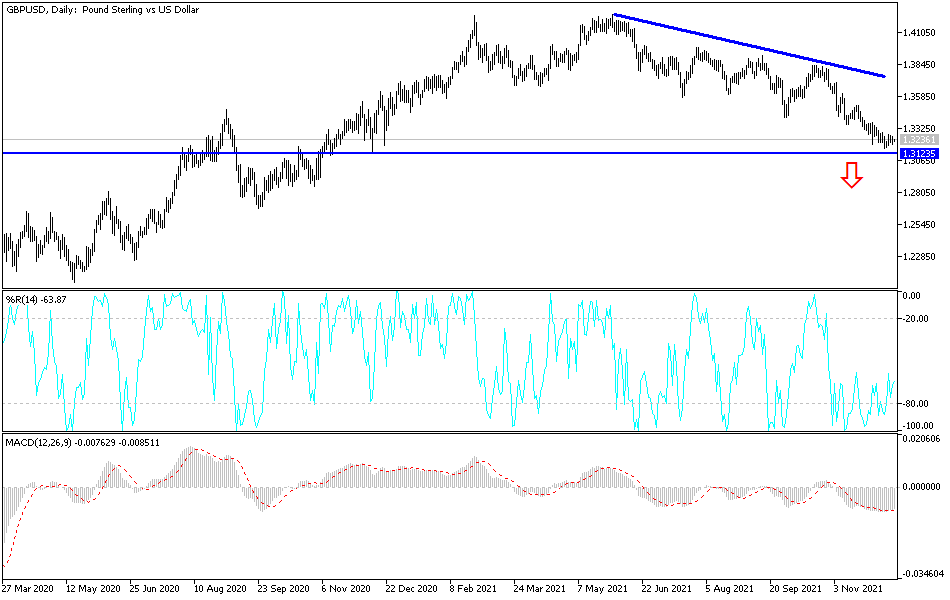

On the daily chart below, it seems clear that the GBP/USD is stable in narrow ranges amid bearish momentum. This performance for several sessions in a row warns that a strong move will occur. Investors will continue to balance between what the Federal Reserve will announce today and the improvement in the sectors of the US economy, and political anxiety and facing the new COVID variant with its restrictions in Britain. So far the weakness factors for the pound and a breakdown past the 1.3160 support might bring the necessary strength to move towards the psychological 1.3000 support.

On the upside, and in the event of a correction, the currency pair may move towards the 1.3365 and 1.3515 resistance levels but so far I still prefer selling the currency pair from every bullish level.