Despite the high inflation figures in Britain, the GBP/USD currency pair fell to the 1.3171 support level. This comes after strong indications from the Federal Reserve that it will ending its bond-buying program and raise interest rates three times next year. But the currency pair quickly recovered to the resistance level of 1.3273 as the markets had already priced that in, and it is settling around the 1.3250 level in anticipation of what the Bank of England will announce later today.

Many GBP investors are counting on what the Bank of England says about the UK interest rate outlook and whether there has been an escalation in the recent return of coronavirus-related restrictions on business activity and social practices. And given the headwinds from Omicron, higher energy and food prices and the National Insurance tax increase next year, we only expect a bank rate hike by a total of 40 basis points next year, which is well below the roughly 100 basis points previously priced.

Analysts lowered their forecasts for the British pound amid expectations that these expectations will decline in the coming months, and British Prime Minister Boris Johnson has appealed to Conservative lawmakers to support him by voting on new restrictions to help slow the spread of the fast-spreading Omicron. Lawmakers cheered Johnson - but nearly 100 defied him, and voted in the House of Commons against requiring vaccine passports for nightclubs and other crowded places. The rebellion did not overcome the measure, which was approved with the support of the opposition and took effect on Wednesday. But it could have major implications for Johnson's political future and for Britain's response to the pandemic.

Johnson's government argues the restrictions are necessary to counter the "serious threat" from the highly transmissible omicron variant, which is spreading so quickly that it could overwhelm British hospitals even if it is less severe than previous strains.

The British prime minister's popularity has fallen amid political upheaval and moral scandals. And it seems certain that any further restrictions related to the coronavirus will meet strong resistance from the Conservatives, leaving Johnson to rely on the opposition for approval. Despite Johnson's success in ending the Brexit saga quickly, the epidemic toppled Johnson off course. His initial reluctance to impose a nationwide lockdown in early 2020 helped give the UK the highest number of coronavirus deaths in Europe excluding Russia, with more than 146,000.

A successful vaccination program helped Johnson regain some of his power, but a series of harmful allegations tarnished him.

A general election in Britain is not due until 2024, so Johnson may have time to recover. His popularity could soar if the Omicron wave that has swept the UK isn't as bad as many fear, and Johnson has achieved his goal of having a booster vaccine available to all adults by New Year's Eve.

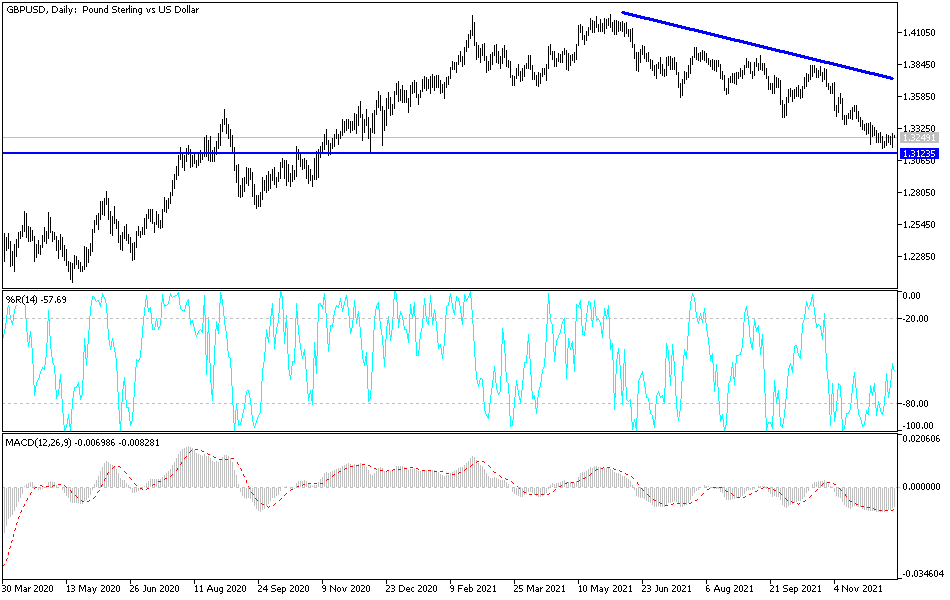

Technical Analysis

Bearish stability still dominates the performance of the GBP/USD currency pair. The currency pair is trying to avoid stability below the support 1.3200 so that the bears do not have enough momentum to move towards the psychological support 1.3000. On the other hand, a breach of the current bearish channel could have the bulls rushing to the resistance levels at 1.3420 and 1.3660, otherwise the general direction of the pair will remain bearish. British political and health concerns will continue to pressure any sterling gains.

The pound will be strongly affected today by the announcement of the PMI readings for the manufacturing and services sectors in Britain and the Bank of England’s announcement about updating its monetary policy decisions.