Amid limited momentum, the pound rose against other major currencies. The GBP/USD moved to the 1.3286 resistance, then returned to settle around the 1.3250 level as of this writing. The GBP/USD was stable near its lowest levels of the year, and the pound's gains came after comments from Deputy Governor of the Bank of England Ben Broadbent that tightening the labor market may raise inflation, which is likely to comfortably exceed 5 percent in April next year. In a letter to the University of Leeds Business School, Broadbent added: "The overall rate of inflation is likely to rise further over the next few months, and chances are it will comfortably exceed 5% when the Ofgem (regulated) cap on retail energy prices is adjusted next April."

A tight labor market could fuel inflationary pressures, if wages continue to rise due to competition for workers. However, Broadbent said he has not made a decision on his rate vote next week amid the uncertainty surrounding Omicron.

On the economic front, survey results from IHS Markit showed that UK construction activity expanded sharply in November, led by the fastest recovery in business since July amid the reopening of the economy. Accordingly, the construction PMI rose to 55.5 in November from 54.6 in October.

In general, the GBP/USD fell strongly during the year due to a group of economic risks and developments in the central bank’s policy, which may push it to decline continuously during the next week, which may lead to testing the main support levels directly below the current market. Sterling was once again one of the biggest declines in another bloody week for risk assets, as losses pushed the sterling price to new lows in 2021 below 1.32 support in price action only half of which was in response to uncertainty over the risks posed by the latest strain of COVID.

This, along with adding weight to the sterling rate, was changes in expectations for the central bank's policies after last week's testimony to Congress from Federal Reserve Chairman Jerome Powell. This led the market to expect a faster pace of monetary policy normalization in the US, just as investors became more conservative in their expectations regarding the Bank of England (BoE) rate.

Concerns about the potential global economic turmoil caused by the recent surge of the coronavirus weighed heavily on risk currencies such as the British pound last week. The US dollar also appears to have been supported by a sharp rise in US government bond yields after US Federal Reserve Chairman Jerome Powell told Congress that the risks of US inflation remaining above target are likely to call for a faster end to the Federal Reserve's bond-buying program than is currently mandated .

The GBP/USD came under severe pressure as financial markets quickly came to expect that next week's meeting on December 15th will see the Federal Reserve replace the November plan to end the quantitative easing program of $120 billion per month by the end of June 2022 with the purchasing activity of the bank being scaled back until the end of March 2022.

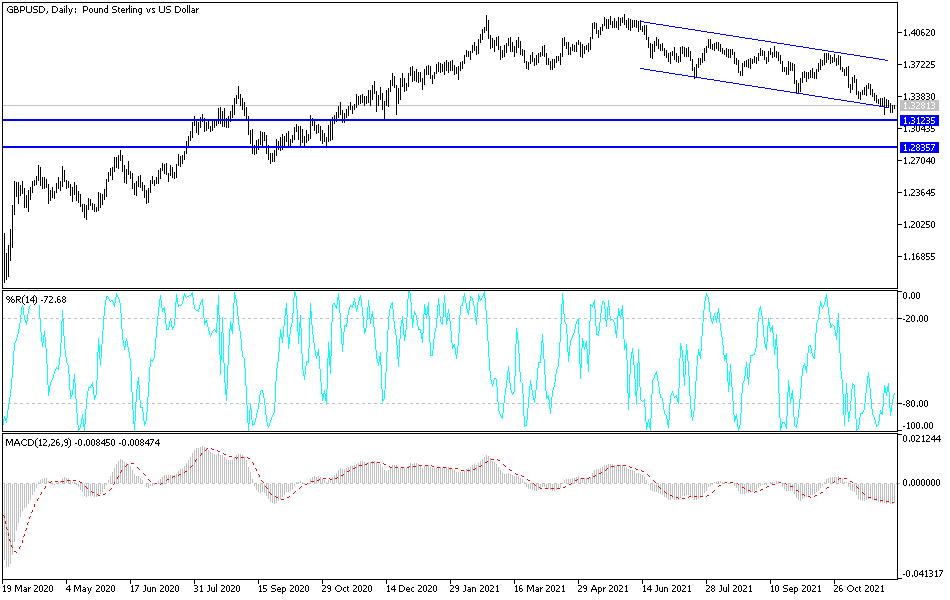

Technical Analysis

The bears are not perturbed about the arrival of technical indicators to oversold levels after the recent losses of the GBP/USD currency pair, as stability below the 1.3250 support will motivate the bears to move further downward. Therefore, the psychological support at 1.3000 may be possible, especially if the pound does not gain momentum and the US dollar is supported by the expectations of raising US interest rates and the demand for it as a safe haven. On the other hand, according to the performance on the daily chart, the 1.3660 resistance will remain crucial for a strong control of the bulls and an important reversal of the current bearish trend.