Speculations that Britain would impose restrictions to contain the outbreak of the Omicron variant increased the suffering of the British pound against the other major currencies. The GBP/USD currency pair retreated quickly to its lowest support level of the year, 1.3160, before settling around the 1.3240 level as of this writing. Overall, it appears that politically jittery British Prime Minister Boris Johnson has rushed forward with plans to introduce stricter Covid-19 restrictions in order to slow the spread of the Omicron variant, but it will negatively impact British businesses, consumer sentiment, and eventually sterling in the Forex market.

According to Politico's London Playbook editor Alex Wickham, Johnson is considering implementing "Plan B restrictions as omicron variant cases rise - and a coronavirus press conference is scheduled soon." Plan B includes working from home and the possibility of some kind of Covid passport system. The developments have since been confirmed by a group of other journalists.

In this regard, Noa Hoffman from Politics Home says that the procedures are coming and that the request to work from home will start as of tomorrow. The demand to work from home will have a significant impact on economic activity and potentially very harmful to businesses that rely on office workers.

The developments are likely to slow economic activity into the end of the year and convince the BoE that now is not the time to raise interest rates. Markets are now anticipating a February rate hike, but the risk to the economy by the government's response to Omicron may soon reduce investors' odds - or expected range - for a rate hike in February. This should add further pressure on the GBP exchange rates which are sensitive to fading up bullish expectations.

Talk of a move to tighten Covid restrictions surfaced as the British prime minister came under fire for refusing to hold a Christmas party at Number 10 one year ago; although there is clear evidence that it actually happened. Chatter has suggested that introducing stricter rules for Covid is a direct effort to try to shift focus away from scandal. Tom Newton Dunn of Times Radio says there are signs the decision to implement Covid controls is already hasty: “There is concern about the speed with which this decision-making is moving in Whitehall. I have been told that the Covid Taskforce has so far not submitted its papers to the Prime Minister and Minister of Health on Plan B, which was due later in the week."

Johnson's former aide, Dominic Cummings, tweeted following the video that proves Number 10 has in fact hosted a party that "regime change is coming." Cummings has been highly critical of the prime minister since leaving office, and his view is speculative. But, if true, any pressure on Johnson to step down poses additional risks to the pound, which tends to underperform in times of domestic political uncertainty.

Regardless, the economy will be the biggest loser from these decisions and these developments are likely to be reflected in the performance of the pound. Incoming short-term data suggest that consumers have already pulled back, fearing a new wave of the virus at some point in the future. The significant domestic and global focus on the Omicron variant is a source of new concern with real-time data showing consumers are falling behind in public places such as gyms, bars and restaurants.

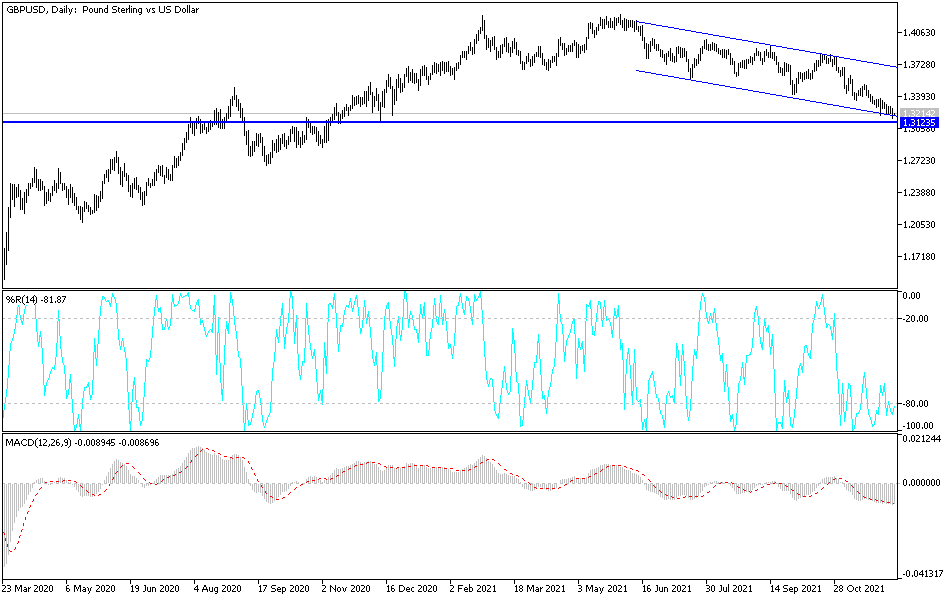

Technical Analysis

The GBP/USD pair's bullish rebound attempts will depend on risk appetite and fear surrounding the virus. The pound may remain subject to fluctuation in light of the recent political and health developments in Britain. So far, the general trend of the GBP/USD pair is bearish, and the next support levels for the pair will be 1.3190 and the psychological support 1.3000.

On the upside, and according to the performance on the daily chart, the resistance levels 1.3530 and 1.3660 are the most important for a change in the current trend.