The euro could not keep the gains from the European Central Bank’s announcement that it would begin to tighten monetary policy in the footsteps of other global central banks. The EUR/USD fell to the support level 1.1235 at the end of last week’s trading after reaching the 1.1360 resistance level in the same week. The euro gained momentum in the Forex market after the European Central Bank (ECB) revealed its plan to end its pandemic-inspired quantitative easing program, although some analysts say the euro will likely start to struggle at any approach at the 1.14 resistance.

Last week, European Central Board members agreed on a step-by-step process to end the ECB's 1.85 trillion euro pandemic emergency purchase program by using a temporary increase in the bank's original bond purchase, the asset purchase program, to plug the gap.

The ECB is set to continue purchasing approximately €100 billion per month until the end of March 2022 when the PEPP expires with the original APP increased to €40 billion per month for the second quarter and €30 billion for the third quarter. After this point, the original APP will resume at its previous pace of €20 billion per month "for as long as necessary to enhance the adaptive effect of its policy rates", which could take until 2024 according to the latest ECB projections.

“ a gradual step towards a more hawkish – albeit very watered down” European Central Bank, says Mazen Issa, senior FX analyst at TD Securities.

Otherwise, the European Central Bank left the interest rates charged or paid on major refinancing operations, the marginal lending facility and the bank deposit facility unchanged at 0.00%, 0.25% and -0.50% respectively, although the prospects for a final increase may have been improved with the latest ECB inflation expectations. .

Bank Governor Christine Lagarde announced sweeping upgrades to the European Central Bank's inflation forecasts over the coming years at her press conference, with the annual rate reaching 2.6% for 2021, 3.2% for 2022 and 1.8% for both 2023 and 2024. Experts believe that the forecast upgrades for December bring the annual inflation rate within reach of the identical 2 percent target at the other end of the forecast horizon, and take the bank a step forward in the direction of its long-sought policy target. It comes after inflation in the Eurozone rose to a record high in November following sharp increases in energy costs as well as in a wide range of other prices, reflecting the increases believed to be mainly caused by the ongoing disruption in international supply chains.

While the euro benefited from the diminishing announcement, there were doubts among analysts about whether it could sustain a recovery against the dollar and other currencies due to the growing divergence between expectations for interest rates in the Eurozone and elsewhere. It comes after the Federal Reserve announced in the same week that its $120 billion per month quantitative easing program would expire in March 2022 and warned, using its dotted chart, of policy makers' expectations that US interest rates are likely to rise by up to three occasions. .

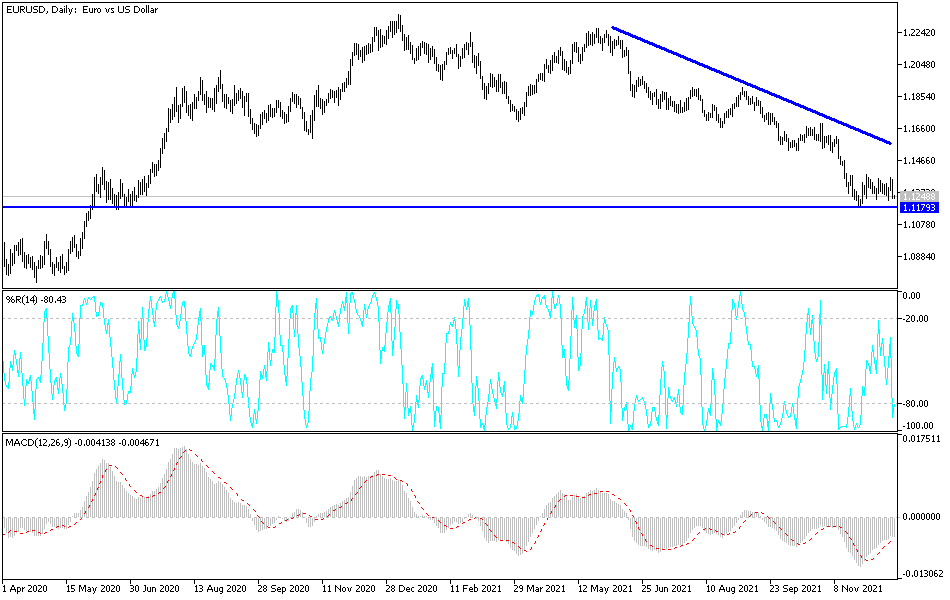

Technical Analysis

There is no change in my technical view. The trend for the EUR/USD currency pair will remain bearish as long as it is stable around and below the 1.1300 support level, which will open for a move towards the 1.1245 and 1.1180 support levels and the 1.1000 psychological support. On the upside, and according to the performance on the daily chart, the bulls need to break through the resistance levels 1.1385 & 1.1525 to have a chance to change the direction to the upside.