This week will be an impactful one for the year, so there will be reactions to its events and economic data. On the other hand, the price of the EUR/USD currency pair is showing a strong bearish momentum that paves the way for a new bearish annual close. The most popular currency pair in the Forex market is stable around the psychological support level of 1.1300 amid persistent weakness factors represented in the increasing expectations of the imminent date of raising US interest rates.

This is in addition to European restrictions to contain the new Corona variant, which slows the economic growth of the Eurozone. The European Central Bank is keeping its loose monetary policy, contrary to what the rest of the other global central banks desire. This week the European Central Bank policymakers led by President Christine Lagarde are set to unveil the criteria for future bond purchases as they agree to end emergency purchases in March as previously noted. Officials will also release their first economic forecast for 2024.

On the economic side, the EUR/USD is influenced by the announcement that the German Harmonized CPI for November matched expectations (annual) and (monthly) at 6% and 0.3%, respectively. Before that, it was announced that the EU's GDP for the third quarter exceeded the expected change (on an annual basis) by 3.7% by 3.9%, while it matched (quarterly) with expectations of 2.2%. Elsewhere, German Imports and Exports for October beat expectations, as industrial production also registered a change of 2.8% (MoM) for October versus market expectations of 0.8%.

The US consumer price index rose on an annual basis to the highest level since 1982, which puts pressure on the US Federal Reserve to give sharp signals about the future of its tightening policy this week. Prior to that, it was announced that initial jobless claims in the US last week exceeded expectations by 218K with a reading of 184K claims, while continuing claims lost expectations of 1.9M with a reading of 1.992M.

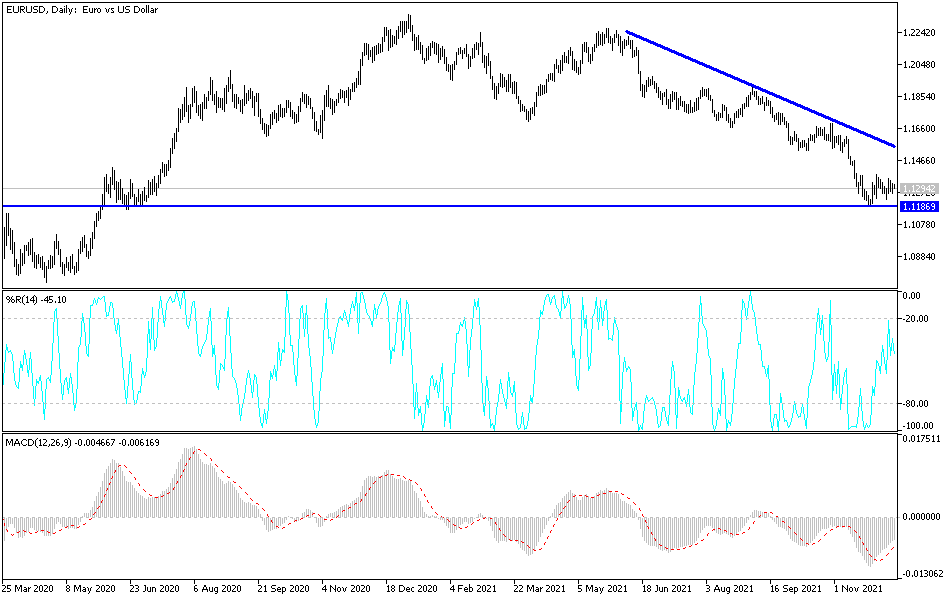

Technical Analysis

In the near term, and according to the hourly chart, the EUR/USD continues to trade within the formation of a bearish channel. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current downtrend towards the 1.1257 support or lower to the 1.1243 support. On the other hand, the bulls will target potential bounces around 1.1295 or higher at 1.1318.

In the long term, and according to the daily chart, it appears that the EUR/USD is trading within the formation of a bearish channel after attempting to reverse the sharp bearish trend. This indicates the continuation of the long-term bearish momentum in the market sentiment. Therefore, the bulls will target potential retracements around 1.1352 or higher at the 1.1442 resistance. On the other hand, the bears will target long-term profits around the 1.1198 support or lower at the 1.1112 support.