For five trading sessions in a row, the rebound gains for the EUR/USD stopped at the resistance level 1.1433, waiting for stronger catalysts to continue the rebound or return to the bearish trend. This week is devoid of important economic releases, bearing in mind that the decrease in liquidity due to the holidays may lead to volatile movements. Meanwhile, the US dollar is also looking at a relatively empty economic calendar. A lot of price movements can be dictated by risk flows or profit-taking actions, especially since traders may be on vacation until the start of 2022.

As it stands, the focus remains on the Omicron variant and some restrictions are being reintroduced to limit its spread. This may reduce risk appetite for the time being, as investors anticipate another wave of downside pressures on business and consumer activity.

A breakthrough in the European gas sector contributed to improving sentiment towards the euro. In this regard, said Stephen Gallo, Forex analyst at BMO Capital Markets, said: “In light of the various developments this year, we look forward to the continuation of the 'energy security risk premium' for the euro. We believe that Europe's energy transition and relatively high input costs will act as constraints on domestic growth, industrial profit margins, and Eurozone competitiveness (particularly versus Asia). He added, “Our basic assumption is that the euro will moderately decline against the dollar during the first half of 2022, with spreads supporting the US dollar as the Fed heads towards raising interest rates while the European Central Bank continues the path of quantitative easing.”

While the economic headwinds from rising energy costs have had a stifling effect on the euro, it was the difference between the monetary policies of the European Central Bank (ECB) and the Federal Reserve (Fed) that drove much of the EUR/USD rate down -7.14% During 2021 until Friday. This divergence has been widely cited by many analysts as the dominant reason for expectations of further declines in the euro and dollar over the next year, while December policy updates from both central banks did little to change bearish market views.

The Fed's policy decision has accelerated the end of the bank's quantitative easing program to expire in March 2022 instead of June and came with economic forecasts showing that a majority of FOMC members view themselves in December as likely to vote for three increases in the federal funds rate next year.

Meanwhile, although the European Central Bank laid out a plan to end its €1.85 trillion pandemic emergency purchase program in March and steadily return over the months to October 2022 to the pace of its pre-pandemic purchases under the bank's original asset purchase programme, Frankfurt continued to discourage the market. The market is not expecting any changes in the interest rate in the foreseeable future.

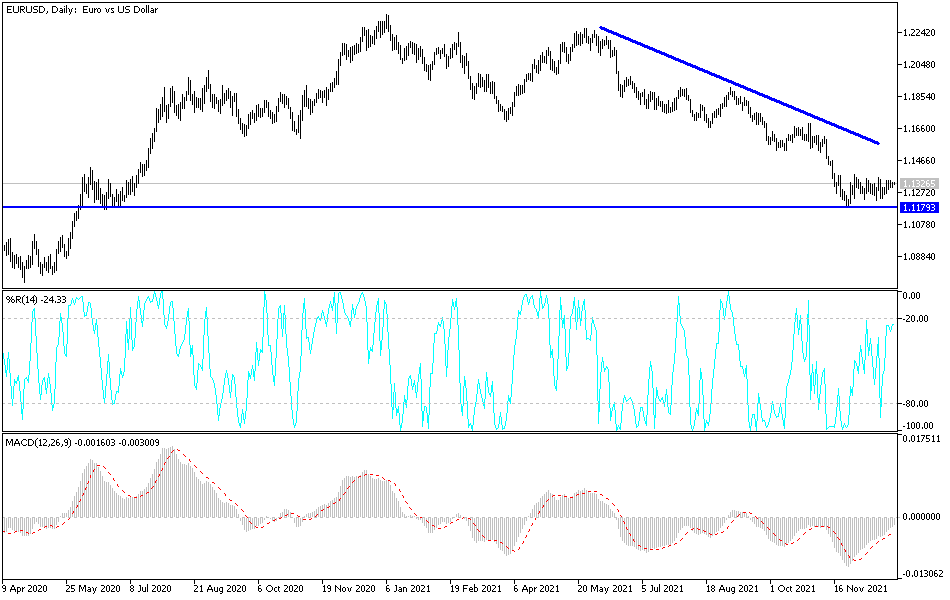

Technical Analysis

The EUR/USD currency pair formed declining tops and ascending bottoms to settle within the triangle formation appearing on the four-hour chart. The price is testing resistance and may be due to a pullback back to the support around the 1.1300 level. So far the 100 SMA is still below the 200 SMA to show that the general trend is still bearish and that there is a possibility that the triangle support will be broken. If so, the EUR/USD could fall as high as the chart pattern, which spans around 200 pips.

Then again, the gap between the indicators narrows to reflect weak selling pressure or a possible bullish crossover. If so, buyers may step up to defend the floor and possibly push for an upward breakout. The RSI is on a middle ground to reflect neutrality, and hardly provides any solid directional clues at the moment. The stochastic is pointing down to indicate selling pressure, and the oscillator has room to slip before it reverses oversold levels.