Today's trading session is important for the EUR/USD, as the US Federal Reserve will announce its decision regarding tightening its monetary policy. Since the beginning of this week's trading, the price of the EUR/USD currency pair has been moving in narrow ranges because investors need more clarity and are not taking risks until they know what will happen today. The currency pair is between the 1.1323 resistance level and the 1.1253 support level.

The European Central Bank's new projections show inflation below the 2% target in both 2023 and 2024, according to officials familiar with the matter, giving ECB Governor Christine Lagarde ammunition to oppose the rapid increase in interest rates, which of course negatively affects the euro. Officials said that while consumer price growth for next year will be stronger than the 2.2% forecast in September, it will slow then over the forecast horizon.

The forecast, which extends to 2024 for the first time, is a key input in shaping the ECB's post-pandemic policy path. The forecast is not official until published by the Governing Council after its decision on Thursday. A spokesman for the European Central Bank declined to comment. The upcoming meeting is likely to be one of the most important since Lagarde took office in 2019 as policymakers discuss changes to conventional asset purchases and how to reinvest maturing debt after the emergency bond purchase expires in March.

Most economists do not expect the first increase in the price until 2023 at the earliest, while money markets are betting on a 10 basis point increase in December 2022. Lagarde was doing her best to steer investors against expecting such an early move, insisting that the current rise in inflation, which is now 4.9%, is temporary. A future outlook that shows a consumer price gain of less than 2% on the horizon may reinforce this view.

However, the strength of this argument may depend on the extent to which inflation falls below target in expectations. The closer to 2%, the easier it is for hawkish policymakers to stress the risk of price pressures entrenching. According to one official, the forecast will show inflation just below target in both 2023 and 2024, and does not take into account elements that could prove upside risks. Such factors include the cost of owner-occupied housing - a new consideration since a review of the European Central Bank's strategy released in July - and a number of policies announced but not yet implemented such as a 25% increase in Germany's minimum wage, the official said.

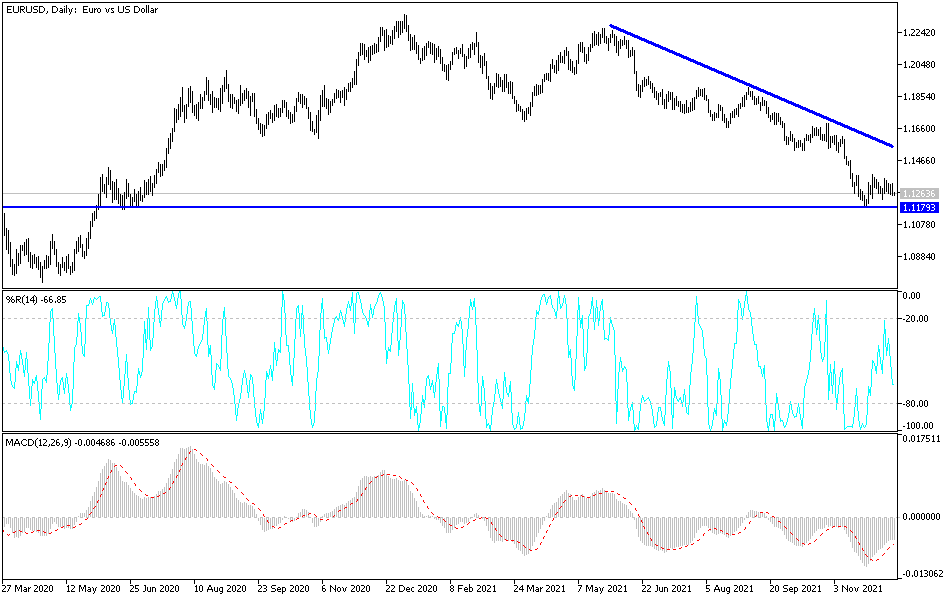

Technical Analysis

The bearish stability of the EUR/USD on the daily chart below is still valid, and as I mentioned before, if stability remains below the 1.1300 support, it allows for more downward movement. The current weakness factors for the euro will continue the current trend, for which the next support levels are 1.1225, 1.1170 and 1.1090. Today's data and events are sufficient to determine the future of the currency pair's closings for this year and not just for this week.

If the US Federal Reserve indicates today that it will postpone raising interest rates, that may bring the EUR/USD currency pair the opportunity to compensate for some of its losses, but bear in mind that the rebound will not be large and continuous because the euro is facing stronger weakness factors on the other hand. But if that happens, the resistance levels may be 1.1360 and the crucial 1.1660 high on the daily chart to cause a breach of the current bearish channel.