Despite the announcement of better-than-expected GDP growth for the US, the US dollar declined amid profit-taking before the holidays. This affects market working hours and liquidity, and the EUR/USD had the best chance of rebounding to a higher level. It touched the 1.1340 resistance, where it settled as of this writing and before the announcement of the second bundle of US economic data.

The euro's gains may collide with disappointment about European restrictions to contain the rapid spread of the Corona variant.

Yesterday, the US Commerce Department said the US economy grew by 2.3% in the third quarter, slightly better than previously thought. But the prospects for a strong recovery in the future are clouded by the rapid spread of the latest type of coronavirus. The third and final look at the performance of GDP, the country's total output of goods and services, was higher than last month's estimate of 2.1% growth.

The newfound strength came primarily from stronger consumer spending than previously thought, as well as companies rebuilding their inventories more than initial estimates revealed. The third-quarter gain of 2.3% came on the heels of explosive growth that began the year as the country emerged from the pandemic, at least economically. Growth jumped to 6.3% in the first quarter and 6.7% in the second. The emergence of a summer delta variant was blamed for much of the slowdown in the third quarter.

Now with the emergence of the omicron variable, which comes on top of high inflation and lingering supply chain issues, there are fears that growth could be constrained as 2022 approaches. These concerns have sent the stock market on a turbulent ride in recent days, despite new optimism that omicron risks could be controlled, and the Dow Jones Industrial Average rose 560 points on Tuesday and rose another 261 points on Wednesday.

For his part, US President Joe Biden on Wednesday held a meeting of the task force on supply chain disruptions in Washington, where he promoted what he said was significant progress in relieving bottlenecks at ports and other issues that have caused merchandise shortages and contributed to higher prices for consumers. Biden said retail stocks are up 3% from last year and product availability on shelves is 90%, which is close to what it was before the pandemic.

The head of the World Health Organization has warned that comprehensive booster programs in rich countries risk prolonging the COVID-19 pandemic and says that "no country can work its way out of the epidemic." While vaccines have saved many lives this year, their unequal sharing "cost many lives," said WHO Director-General Tedros Adhanom Ghebreyesus.

Tedros had previously called for a moratorium on booster use for healthy adults until the end of this year to counter the uneven distribution of vaccines globally. Currently, about 20% of the vaccine doses given daily are boosters, Ban said. He added that "comprehensive booster programs are more likely to prolong the epidemic than to end it, by diverting supplies to countries that already have high levels of vaccination coverage, giving the virus a greater opportunity to spread and transform."

Technical Analysis

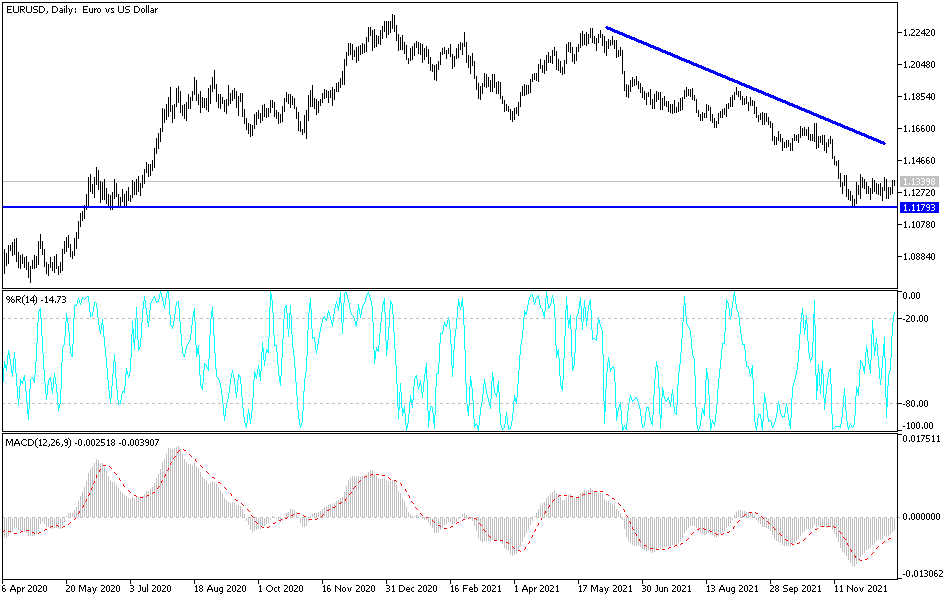

Despite its recent gains, the EUR/USD currency pair is still in a bearish trend. For that to change, the bulls need to break through the resistance levels 1.1485 and 1.1620. This is according to the performance on the daily chart below. On the downside, a move below the support at 1.1300 will still support the bearish trend. I still prefer to sell the EURUSD currency pair from every bullish level.

All focus will be on US economic data, which include the announcement of durable goods orders numbers and the reading of the personal consumption expenditures price index, which is the how the Federal Reserve measures inflation in the country, in addition to announcing the reading of the number of weekly jobless claims and home sales.