I have said that during this last week of 2021, price movements will not be stable and may lack the strong movement required for trading. In the case of the EUR/USD currency pair, for example, it fell during yesterday's trading to the 1.1273 support level, and quickly rebounded upwards to reach the 1.1368 resistance level. It is stable around the 1.1340 level at the time of writing, ahead of the announcement of the latest data affecting investor sentiment. The global financial markets, including the Forex trading market, are still watching with caution the reaction to the rapid spread of the new Corona variant, which poses a threat to the global economic recovery.

To counter the epidemic, the French government is pressing ahead with efforts to increase pressure on unvaccinated people to get coronavirus vaccines, with the omicron variant causing a record increase in infections. In a parliamentary hearing on Wednesday afternoon, the health minister plans to defend the French government's plan to allow only fully vaccinated individuals access to places such as restaurants, cinemas, theaters, museums and sports arenas. Accelerating the introduction of the so-called "vaccine corridor" is part of a government strategy to use vaccines, rather than new lockdowns, in an effort to mitigate the impact of the rapidly spreading omicron variable on already overburdened hospitals.

France has reported nearly 180,000 new cases of COVID-19, a daily record, and is preparing for the number to continue to rise, with forecasts warning of more than 250,000 possible daily infections by January. France has vaccinated more than 75% of its population and is speeding up its use of booster shots, but more than 4 million adults in the country remain unvaccinated.

The government wants the vaccine permit requirement to be in effect by mid-January. If approved by Parliament, the plan means that unvaccinated people will not be able to use negative test results to visit places that require a permit.

Germany's health minister said the country's coronavirus infection rate is likely to be two to three times higher than statistics currently show, and urged his citizens to exercise caution during New Year's celebrations. Yesterday, German official data showed 4,043 new cases were reported in the past 24 hours and an infection rate of 205.5 new cases per 100,000 residents over the past seven days.

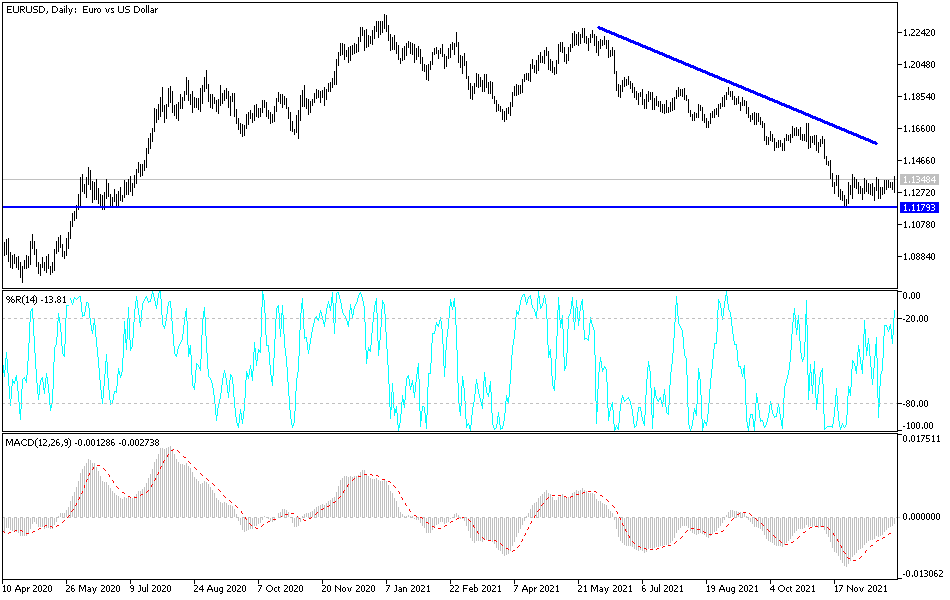

Technical Analysis

The EUR/USD pair is still trying hard to break the support barrier that is still supported by the move towards and below the support level 1.1300. Bulls still need to break the resistance levels 1.1385, 1.1455 and 1.1530 to confirm control of the currency pair. On the other hand, the 1.1255 support level is the most important for the bears' control. I still prefer selling the currency pair from every ascending level.

The currency pair will react to investors' appetite for risk, as well as the Spanish CPI reading, then the US weekly jobless claims and the Chicago PMI reading.