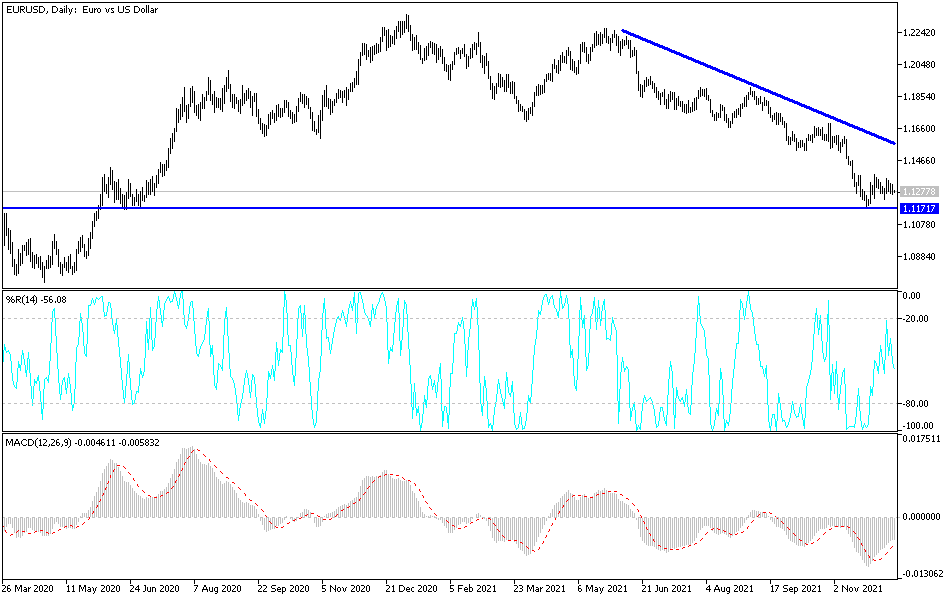

The EUR/USD did not change much last week, but it could see more volatile trading during the coming days after policy decisions of the Federal Reserve (Fed) and the European Central Bank (ECB). These decision will be likely to tell us whether the euro can continue to hold on to a support level below 1.13. Currently, the EUR/USD is stabilizing around the 1.1292 level, after it fell to the support level at 1.1260 in the same trading session yesterday.

The euro has been holding in a tight range against the dollar since a massive sell-off in global markets in late November led to what appeared to be a broad market abandonment of bets against the lower-yielding currencies that had been borrowed and sold previously in order to fund bets on assets with high yields elsewhere. This fixation has kept the EUR/USD confined between 1.1227 and a high of 1.1354 last week, but with the key monetary policy decisions of the Federal Reserve and the European Central Bank bearing on sentiment in quick succession over the coming days, there is a possibility that the price action will result in another break in the trend or collapse of the European single currency.

Commenting on the performance of the EUR/USD, Juan Manuel Herrera, strategist at Scotiabank said: “The EUR/USD has held the 1.1250-1.1350 range for the greater part of the past two weeks as it consolidated its losses during the month of November (which pushed it into oversold territory)." “The euro’s failure to make significant progress at the 1.14 mark indicates a resumption of its downtrend in the coming days towards a retest of the 1.12 support and the November 24 low at 1.1186. The average support is 1.1228.”

All in all, the EUR/USD has repeatedly tried to get below the support provided by the 61.8% Fibonacci retracement of the 2020 recovery trend, but has rarely been able to close below the threshold on a daily basis and has yet to maintain a weekly close below it. However, there is a risk that the Fed's decision on Wednesday could prompt a renewed bearish trend if the bank's latest economic forecasts indicate that it may start raising US interest rates by the second quarter of next year and on three or more occasions.

The Fed's decision on Wednesday follows the December update from the European Central Bank, which will have the final say on whether the EUR/USD rate is doomed to fall below the support line at 1.1292 or if it is able to extend the late November recovery sometime. Below 1.1200 the euro will face multiple layers of technical resistance on the charts in the event of any recovery, and the catalyst for such an outcome is likely to be found in the ECB's new inflation forecasts and the expected decision - or lack thereof - on the future of quantitative easing programmes.

Technical Analysis

There is no change in my technical view of the performance of the EUR/USD currency pair. The general trend is still bearish and stability below the 1.1300 support increases the bearish momentum. The closest support levels for the currency pair on the daily chart are currently 1.1230, 1.1180 and 1.1090. On the upside, in the same time period, a breakout of the resistance 1.1485 and 1.1600 will be a breakout the current bearish channel.

Today, the industrial production rate in the Eurozone will be announced, followed by the producer price index will be announced in the United States.

I still prefer selling the currency pair from every bullish level.