The euro initially tried to rally on Tuesday but gave back early gains to show signs of weakness again. Ultimately, this is a market that I think will find reasons to fall, not the least of which will probably end up being the Federal Reserve and its meeting over the next couple of days. After all, the world is waiting to see whether or not the Federal Reserve will speed up tapering, which is essentially accelerating the monetary policy tightening process. That should be good for the US dollar, and will send this market lower as a result.

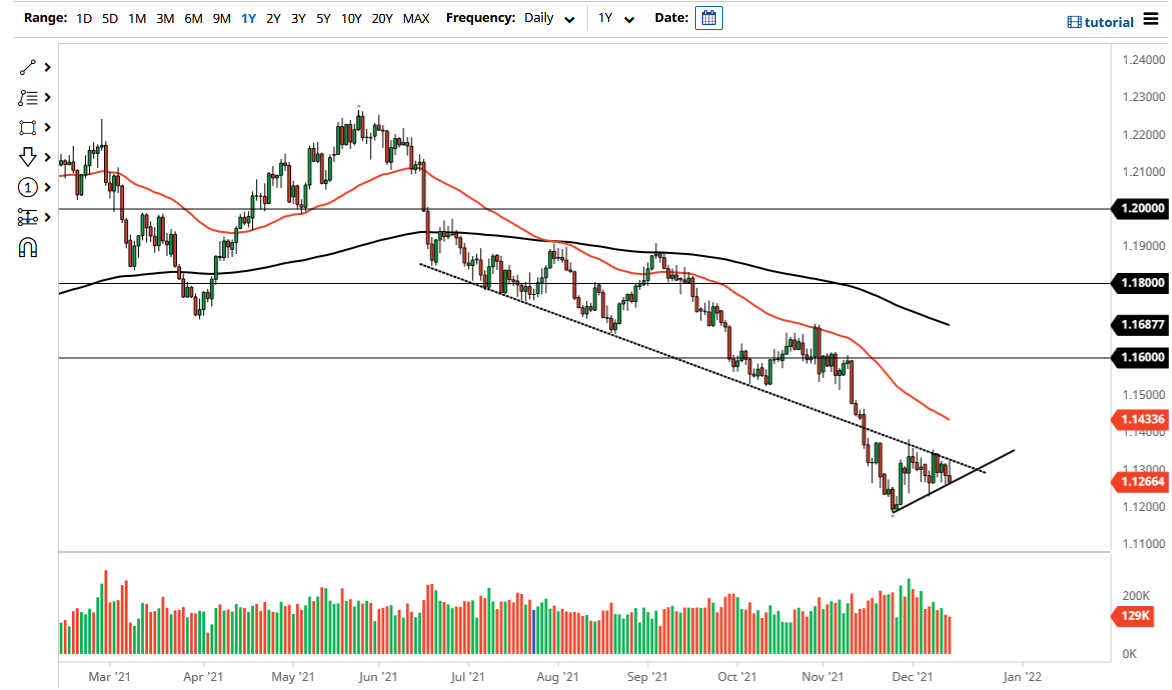

As you can see, we are sitting right at the bottom of the overall triangle that I have drawn on the chart, and it looks as if we are getting ready to make a move. If we were to break down a bit below where we are now, it is likely that we will go looking towards the 1.12 handle, which has been significant support. Breaking down below that level then opens up the possibility of going down to the 1.10 level, which is a large, round, psychologically important level from a longer-term perspective. It is also an area where we have seen a lot of important trading in the past, so it all ties together quite nicely.

If the Federal Reserve suggests that it is going to slow down its tapering process, it is likely that we would see this market rocket straight to the 1.14 handle. I do not expect to hear this, nor does anybody else. It is because of this that if we were to get that surprise, the market would be on the wrong side of everything, and we would see an explosive move. Ultimately, breaking above the 1.14 handle could change the overall trend, at least for the short term, as it would solidify the idea of an ascending triangle that you could make an argument for at the moment.

This is a market that has been in a downtrend for a while, and it’s worth noting that the European Central Bank is extraordinarily loose with its monetary policy, so it does make sense that the world favors the US dollar right now. Beyond that, we have a lot of fears about growth and various parts of the world, which also drive money into the greenback.