The euro shot higher on Tuesday but gave back the gains to form a shooting star-like candlestick. That being said, we are in the midst of consolidation, so I would not read too much into this other than we just are not ready to take off. Ultimately, a lot of this will probably come down to the fact that we are getting close to the end of the year and attracting a lot of position squaring more than anything else.

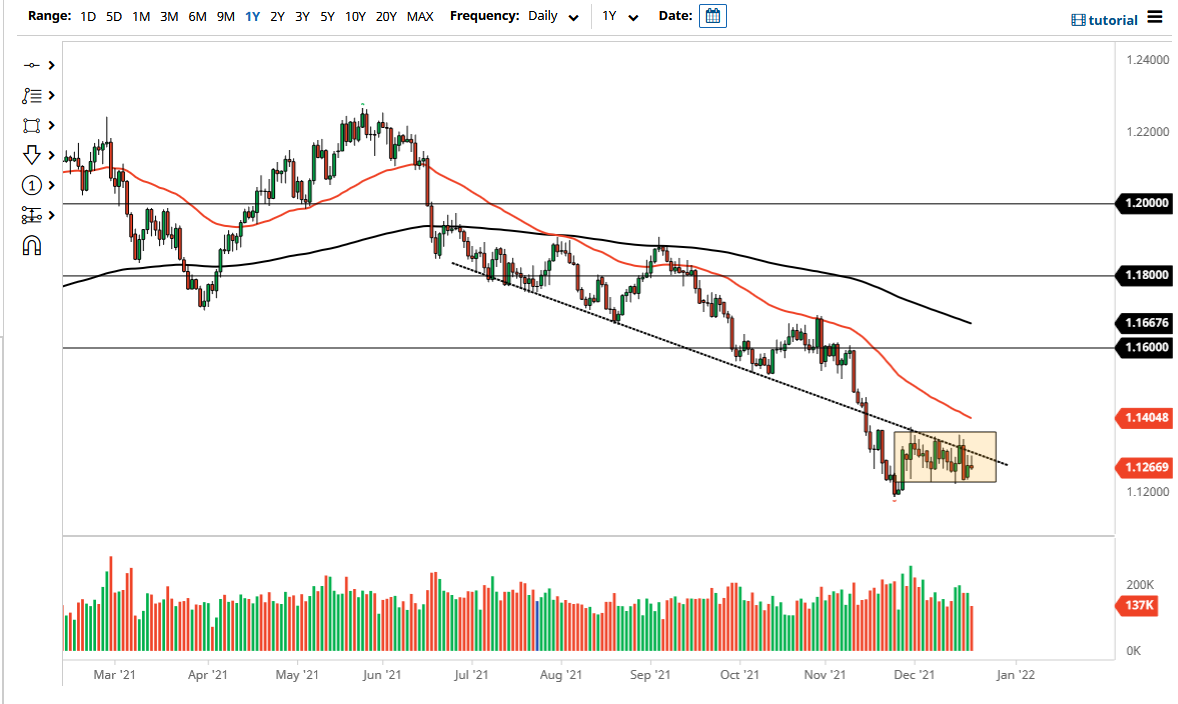

You can see that I have a box drawn on the chart between 1.1375 on the top and 1.1225 on the bottom. We are pulling back from the middle of it, but I suppose you can also make an argument for pulling back from the previous trend line as well. I do not worry too much about the trend line, it is just something that I am using for a bit of a gauge. If we break above it, I would not read too much into it, because I think we will just go looking towards the top of the range more than anything else.

If we were to break above the top of the range, then it is possible that we could go looking towards the 50 day EMA, which is sitting at the 1.1404 level, and will certainly catch a lot of attention. Nonetheless, I think what we are seeing here is more likely than not going to be a scenario where traders are content to kick the ball back and forth to each other as people are worried more about holidays than anything else. That being said, the lack of liquidity could cause a major spike in one direction or the other, so you need to be cautious about your position size, because as soon as you feel comfortable trading large positions back and forth, something will happen to cause the markets the freak out, and then you end up with a margin call. Because of this, be very cautious with your position size but perhaps look to employ range-bound trading systems more than anything else. For that matter, unless you want to sit and babysit the charts, you might simply just take a bit of a two week vacation like most professionals will be doing until next year.