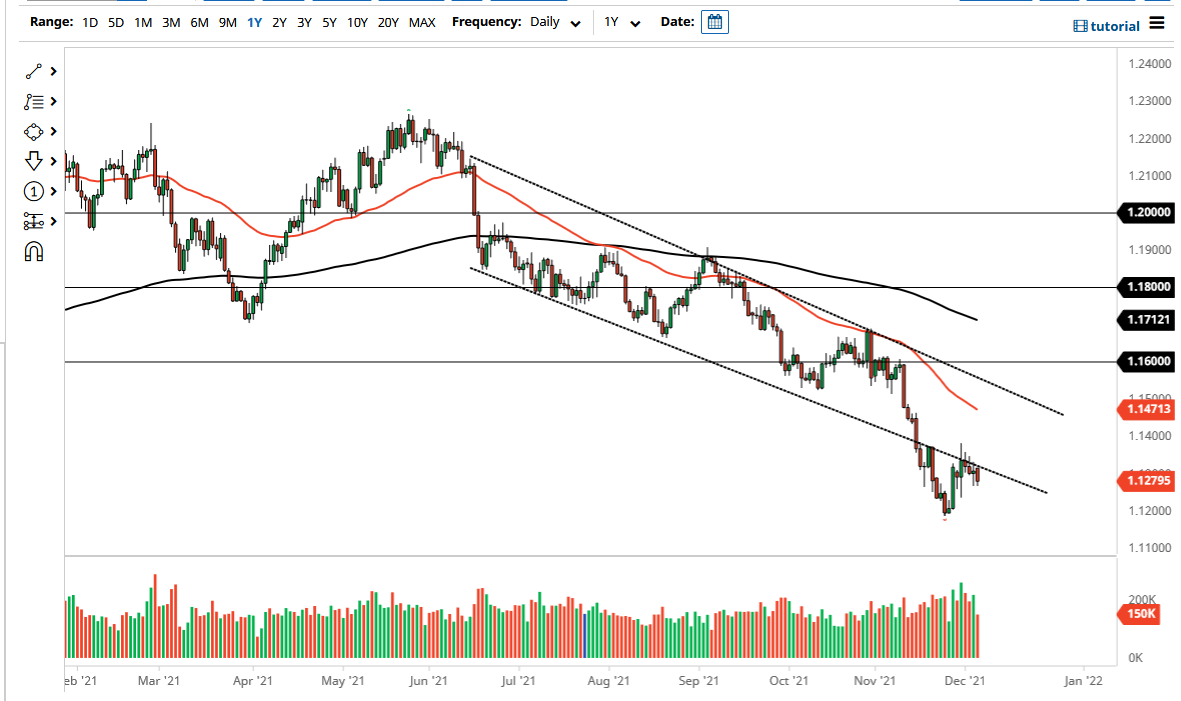

The euro pulled back a bit against the US dollar on Monday, showing signs of hesitation at the previous falling channel, as the market has tried to break above that previous support level that should now be resistance. That being said, the market is likely to continue to see sellers when we get to that area, especially near the 1.13 level as it is right there as well. The market continues to be very noisy in general, so I think that every time we rally it is likely we would see plenty of people who are jumping in the market to short.

The euro is struggling to pick up momentum, as the European Union is struggling overall. After all, the European Union is starting to talk about the possibility of locking people down, which will work against the value of the overall economic movement. That being said, the market is likely to continue to see a lot of trouble, so at this point in time, the market could very well roll over and go looking towards 1.12 level underneath. If we break down below the 1.12 level, then it is likely that we drop down to the 1.10 level, which is a large, round, psychologically significant figure.

I do believe that the 1.10 level is going to be massive support, as it is a large, round, psychologically significant figure, but more importantly, it is also an area where we have seen a lot of action in the past. Breaking down below that level could open up quite a bit of selling pressure. To the upside, we would need to take out the 50-day EMA in order to get bullish, which is something that we are nowhere near doing right now. Because of this, I think it is more likely than not going to be a situation where if you get enough momentum, you will see sellers jump back in to punish this market. The US dollar has been strengthening against almost everything else, so ultimately, I think we are looking at this as a scenario that continues to offer plenty of opportunities, but we may have a little bit of a short-term recovery ahead of us. Nonetheless, it is going to be a while before the buyers get aggressive.