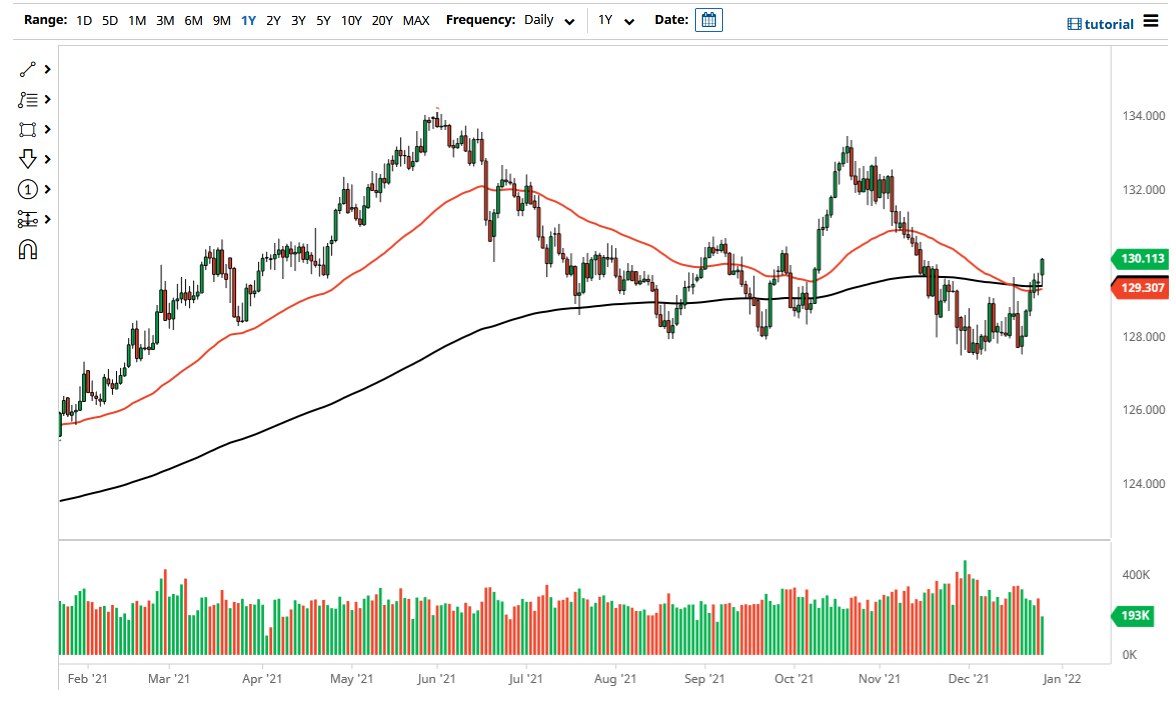

The euro broke rather hard to the upside on Monday, clearing the ¥130 level. This is an area that has been a bit difficult to overcome for a while now, and now that we are above it, there is a certain amount of psychology playing this market now. Furthermore, the Japanese yen itself is getting hammered against almost everything, so it makes a certain amount of sense it would happen here as well, despite the fact that the euro itself is actually a relatively weak currency.

That being said, it looks like the pair is probably going to go looking towards the ¥132 level given enough time, but it may take several weeks to get there. Buying on dips will be my plan going forward, and I certainly do not have any interest in trying to short this pair. The Japanese yen looks miserable against almost everything, so I am not going to try to get too cute and go against the grain here.

The pair is relatively risk sensitive, and we have seen a lot of money flowing into risk assets during the day. I think that will continue to be the case between now and the end of the year as we have the “Santa Claus rally” currently kicking off, and traders are trying to make a little bit of money on the way out the door for the year. The fact that we are closing at the very top of the candlestick suggests that we probably have follow-through coming, and therefore I am perfectly comfortable staying long of this pair and just hanging onto it for a while. With this, I look at short-term dips as reasons to add to a position, not sell it.

It is not until we break down below the ¥129 level that I be concerned about the trend, and even then I think would only be a temporary thing. We formed a nice double bottom, and now it looks like we are ready to continue climbing from these extreme lows in order to make some money. My target at the moment is ¥132, but I think we will probably go even higher than that given enough time, and that is especially true if we get a major “risk on rally” to kick off the year in January.