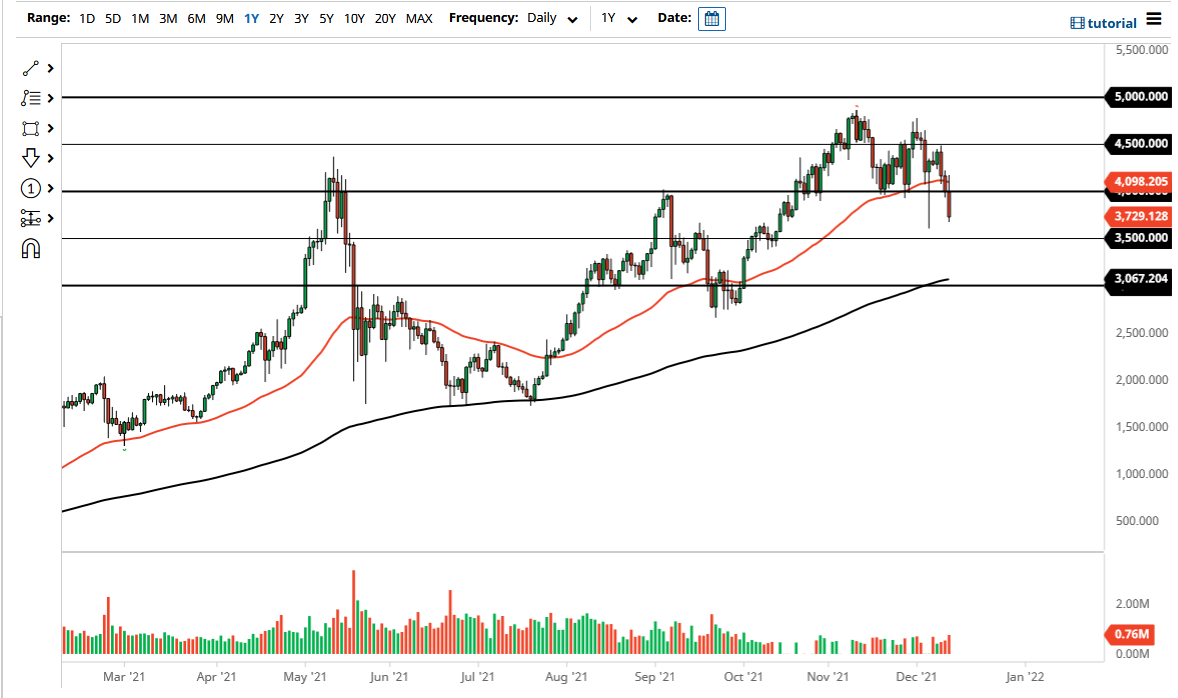

Ethereum fell rather significantly on Monday, slicing through the $4000 level. It fell enough to test bottom of the massive hammer from last week but has bounced from that general vicinity. The real question now is whether or not it will break down through that candlestick, because if it does that would be a rather negative sign. The 50 day EMA currently sits at the 4100 level, which is the top of the candlestick for the session on Monday. That being said, we are still technically in an uptrend, but crypto in general got absolutely hammered for the day.

Whether or not this has anything to do with crypto itself or not is a completely different question, because crypto does not have the direct relation to larger markets around the world. The reality is that when everything else starts the selloff and a major “risk off” type of move, that has a major influence on whether or not people have to be forced to sell this market in order to cover losses in other markets. Nonetheless, the 3500 level underneath now is more likely than not going to be supportive, so it will be interesting to see how this plays out. The market desperately needs to find some type of buying pressure, and it should be noted that crypto is likely to continue being noisy into the end of the year.

However, if you are a longer-term trader like I am, you look at this as a potential opportunity to pick up a little bit of value. After all, Ethereum is going to continue to be one of the biggest building blocks for blockchain in general, and it certainly is not going anywhere. The Ethereum 2.0 launch comes midyear in 2022, and that will drive down a lot of the costs involved in this market. Because of this, I think there are a lot of good things coming down the road, but in the short term you may see a little bit of volatility. As far as the trend is concerned, as long as we can stay above the 200 day EMA, which is sitting just above the $3000 level, we are still technically bullish, so I think it makes a certain amount of sense that we would see this market attract buyers eventually.